Installing solar panels earns you a federal tax credit. This means that you get a credit for your income taxes which actually reduces your tax bill. You may qualify for the ITC for the fiscal year in which you installed your solar panels, as long as the system generates electricity for a home in the United States.

What is the solar tax credit for 2021?

Federal Investment Tax Credit (ITC) At the federal level, you qualify for the Federal Investment Tax Credit (ITC). In 2021, the ITC provides a 26% tax credit on your solar panel installation costs, as long as your taxable income is greater than the credit itself.

How much money do you get back from solar panels on taxes?

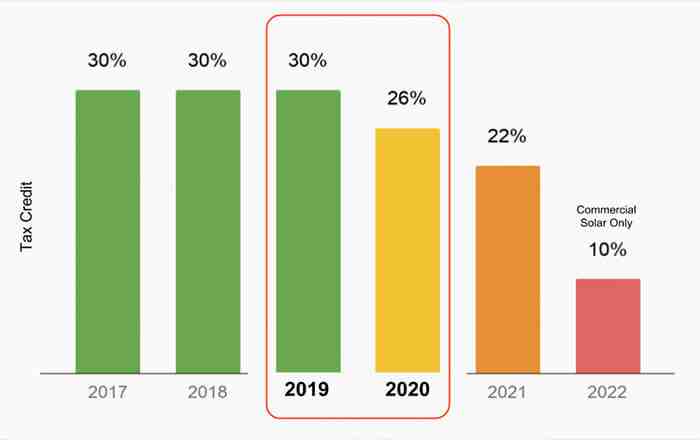

In December 2020, Congress passed an ITC extension, which provides a tax credit of 26% for systems installed in 2020-2022, and 22% for systems installed in 2023. (Systems installed before 31 December 2019 were eligible for a 30% tax credit.)

How does the solar tax credit work if you receive a refund? If you paid $ 5,000 and your tax refund is $ 3,000, you now pay only $ 2,000 in taxes. Your solar tax credit cancels out that $ 2,000 and adds it to your refund check. The remaining $ 1,000 solar tax credit will be deducted from next year’s taxes or whatever you owe again.

Do you get a tax write off for solar panels?

You may qualify for the ITC for the fiscal year in which you installed your solar panels, as long as the system generates electricity for a home in the United States. In 2021, the ITC provides a tax credit of 26% for systems installed between 2020 and 2022, and 22% for systems installed in 2023.

How much of a tax credit do you get for going solar in California?

Although California does not offer a statewide solar tax credit, all residents are eligible for the current federal solar tax credit. The solar tax credit is worth 26% of the value of the installed system and can be claimed on federal tax returns.

Does California have a 2020 solar tax credit? The Investment Tax Credit (ITC) grants an amount of 26% of the purchase cost of your solar system to homeowners before 2020. Having a solar energy system installed in 2020 grants you a maximum of 26% credit. of the solar tax in California before dropping to 22% in. 2021.

How much tax credit do you get for solar panels in California?

If you are a homeowner who installs solar panels in California, you will receive a 26% tax credit on your purchase.

What is the California tax credit for solar in 2021?

Homeowners who install solar panels in California will receive a 26% tax credit on their purchase. It is important to make a clarification here: there is no California-specific solar tax credit.

Does California offer a tax credit for solar?

Federal Tax Credit for Solar Investment Most California residents are eligible to receive the Federal Tax Credit for Solar Investment – also known as ITC. Enacted in 2005 by the Energy Policy Act, the ITC initially covered up to 30% of the cost of installing a solar panel system.

What is the California tax credit for solar in 2021?

Homeowners who install solar panels in California will receive a 26% tax credit on their purchase. It is important to make a clarification here: there is no California-specific solar tax credit.

Will solar tax credits increase 2021?

26% Solar Tax Credit is still available until 2022 In December 2020, Congress extended the 26% federal tax credit for solar energy until the end of 2022. With the elimination schedule gradually original, the solar tax credit was declining to 22% in 2021, and then to 10% for businesses only in 2022 (0% for homeowners).

Does California have a solar tax credit 2021?

One of the largest incentives available to California homeowners is the Federal Investment Tax Credit (ITC). From now until 2021, the federal government will offer a 26% investment tax credit against the total cost of a home solar system. In 2021, the value of the tax credit will drop to 22%.

What will the solar rebate be in 2021?

The Solar Homes program offers eligible Victorian families a refund of up to $ 1,850 of the purchase cost to install PV solar panels. Eligible households can also apply for an interest-free loan equivalent to the repayment amount until June 30, 2021.