How do solar energy credits work?

SRECs are sold separately from the physical electricity produced by your solar panels. Think of them as a “voucher” that proves the electricity from your solar panels is renewable. You earn one SREC for every 1,000 kWh (or 1 MWh) of electricity produced by a solar system.

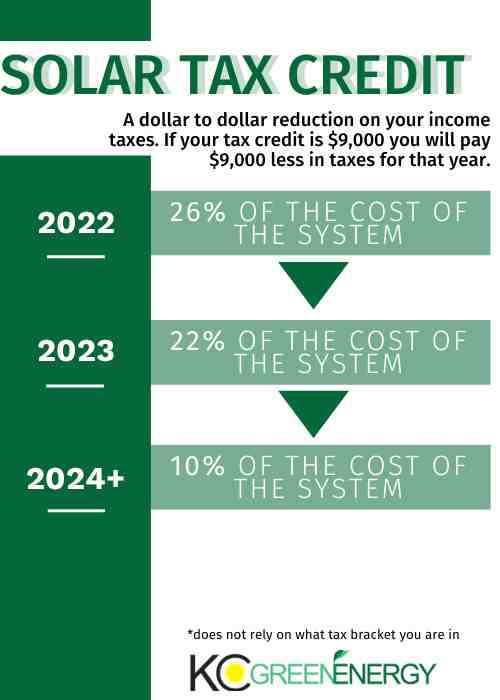

How does the 26% solar tax credit work? When you install a solar system in 2021 or 2022, 26% of your total project costs (including equipment, permits, and installation) can be claimed as a credit on your federal tax return. If you spend $10,000 on your system, you owe $2,600 less in taxes the following year.

How much do you get back in taxes for solar panels?

Solar Tax Credit Amounts Installing renewable energy equipment in your home may qualify you for a credit of up to 30% of your total cost.

How are solar credits calculated?

2016 – 2019: The tax credit remains at 30% of the cost of the system. 2020-2022: Owners of new residential and commercial solar installations can deduct 26% of the cost of the system from their taxes. 2023: Owners of new residential and commercial solar installations can deduct 22% of the cost of the system from their taxes.

How do you get the 26% tax credit for solar?

How do I claim the Federal Solar Tax Credit? After seeking professional tax advice and verifying that you qualify for the credit, you can complete and attach IRS Form 5695 to your federal income tax return (Form 1040 or Form 1040NR).

How does IRS verify solar credit?

Filing Requirements for the Solar Tax Credit To claim the credit, you must file IRS Form 5695 as part of your tax return. You will calculate the credit on Part I of the form, then enter the result on your 1040.

How is residential energy credit calculated?

You may be able to take a credit equal to the sum of:

- 10% of the amount paid or committed for qualifying energy efficiency upgrades installed in 2020, and.

- All residential energy costs paid or incurred in 2020.

How much are solar credits worth?

Although California does not offer a statewide solar tax credit, all residents are eligible for the current federal solar tax credit. The solar tax credit is worth 26% of the value of the installed system and can be claimed on federal tax returns.

How much money do you get back from solar panels?

The average solar payback period on EnergySage is approximately 8.7 years. If your solar installation cost is $20,000 and your system is going to save you $2,300 per year in lost energy bills, your solar panel return on investment or “break-even point” will be 8 .7 years ($20,000/$2,300 = 8.7).

Can I sell my renewable energy credits?

If you own the CERs associated with the power generation of your renewable energy project, you can sell these CERs to another party. By doing so, you lose the ability to make claims on the “use” of renewable energy, but you generate a new source of revenue.

What are renewable energy credits worth?

Homeowners and commercial businesses earn one SREC for each megawatt-hour (MWh) of electricity produced. They can then sell these SRECs to electric utilities. One SREC can be worth $300 or more in some markets, and for a typical 5 kW solar home installation, you could earn six SRECs in a year.

What costs are included in solar credit?

Specifically, the taxpayer may receive a 30% credit for the costs of solar panels and related equipment and materials installed to generate electricity for use by a residential or commercial building.

What are the costs associated with solar? The cost of a solar electric system is measured in dollars per watt. The average cost of a residential system is currently $3-5 per watt. This means that the average 5 kW residential system will cost between $15,000 and $25,000, before tax credits or incentives.

Is labor included in solar tax credit?

All additional solar equipment, such as inverters, wiring and mounting hardware. Labor costs for installing solar panels, including fees for permits and inspections. Energy storage devices that are powered exclusively by solar panels, including solar batteries.

How does IRS verify solar credit?

Claiming the ITC is easy. To get started, you will first need your standard IRS Form 1040, IRS Form 5695, “Residential Energy Credits,” and instructions for Form 5695. The purpose of Form 5695 is to validate your qualification for residential energy credits. renewable energy. .

How is the solar tax credit calculated?

2016 – 2019: The tax credit remains at 30% of the cost of the system. 2020-2022: Owners of new residential and commercial solar installations can deduct 26% of the cost of the system from their taxes. 2023: Owners of new residential and commercial solar installations can deduct 22% of the cost of the system from their taxes.

How does the 30 federal tax credit for solar work?

Currently, this tax credit allows you to claim 26% of the total cost of installing your solar system on your federal taxes. However, this advantage may not be here to stay. Unless Congress extends ITC, it will decrease to 22% for systems installed in 2023 and end in 2024.

How is the solar tax credit calculated?

2016 – 2019: The tax credit remains at 30% of the cost of the system. 2020-2022: Owners of new residential and commercial solar installations can deduct 26% of the cost of the system from their taxes. 2023: Owners of new residential and commercial solar installations can deduct 22% of the cost of the system from their taxes.

How does solar tax credit work if I get a refund?

If you paid $5,000 and your tax refund is $3,000, you have now only paid $2,000 in taxes. Your solar tax credit cancels out that $2,000 and adds it to your rebate check. The remaining $1,000 solar tax credit will be deducted from next year’s taxes or the year you owe again.

How does the solar tax credit Work 2020?

You may be eligible for ITC for the tax year in which you installed your solar panels as long as the system generates electricity for a home in the United States. In 2021, ITC will grant a tax credit of 26% for systems installed between 2020 and 2022, and 22% for systems installed in 2023.

How do you get the 26% tax credit for solar?

How do I claim the Federal Solar Tax Credit? After seeking professional tax advice and verifying that you qualify for the credit, you can complete and attach IRS Form 5695 to your federal income tax return (Form 1040 or Form 1040NR).

Is interest on solar loan tax deductible?

Unlike secured loans, interest on unsecured solar loans is not tax deductible.

Is the interest on the secured solar loan tax deductible? Solar loan options Secured solar loans require you to provide some sort of collateral, usually your home. Secured loans are less risky for the lender, so they generally have lower credit score requirements and lower interest rates. In most cases, the interest you pay on a secured loan is tax deductible.

Is a solar loan secured or unsecured?

There are two main types of solar loans; secure and unsecured. The main difference between the two is that secured solar loans use your home as collateral, while unsecured loans use the solar panels themselves as collateral. Secured solar loans also usually come with lower interest rates than unsecured loans.

How can I get out of a solar loan?

The buy-back method requires you to prepay the balance of what you owe on the solar lease. You can then have the solar panels removed or use the system yourself. Most solar companies that lease include a price and a buy-back period in your contract, so at least they won’t be making the number up on the fly.

Is a solar loan a personal loan?

Solar loans are unsecured personal loans with fixed interest rates and terms of two to seven years. Their short repayment terms allow you to clear the debt faster. Here are five lenders that offer unsecured solar loans, along with details on other financing options.

What is a secured solar loan?

Secured solar loans With a secured solar loan, your lender will require that you pledge an asset, usually your home, as collateral for the money you borrow. This essentially provides “safety” to the lender in case you cannot repay the loan.

Can I write off my solar loan interest?

Yes, you can claim the interest as an itemized deduction if you financed this home renovation. A qualifying loan is a loan that is taken out to add “capital improvements” to your home, which means the improvement must increase the value of your home, adapt it to new uses, or extend its life.

How do I claim my solar on my taxes?

Filing Requirements for the Solar Tax Credit To claim the credit, you must file IRS Form 5695 as part of your tax return. You will calculate the credit on Part I of the form, then enter the result on your 1040.

Does a solar loan affect debt-to-income ratio?

If you are currently financing your solar panels, any payment must be included in your debt to income ratio.

Does a solar loan count as debt?

If the solar equipment was purchased with an installment loan or 2nd mortgage, the debt must be included in the DTI unless the debt is repaid. Some homeowners choose to include their solar panel debt in a cash refinance to achieve this.

Which loan interests are tax deductible?

Types of tax-deductible interest include mortgage interest for first and second mortgages (equity), mortgage interest for investment property, interest on student loans, and interest on certain business loans, including business credit cards.

Is all loan interest tax deductible?

But generally, only mortgage interest qualifies for a tax deduction. Generally, interest paid on a car loan, home equity loans, credit card debt, or loans used for personal finance is not deductible.

What interest expense is not deductible?

Types of non-deductible interest include personal interest, such as: Interest paid on a loan to purchase a car for personal use. Credit card and interest on payments incurred for personal expenses.

Is interest on bank loan tax deductible?

Can you deduct personal loan interest on your taxes? You cannot deduct the interest on an unsecured personal loan from your taxes unless you use the loan proceeds for one of the following purposes: Business expenses. Qualified graduate school expenses.