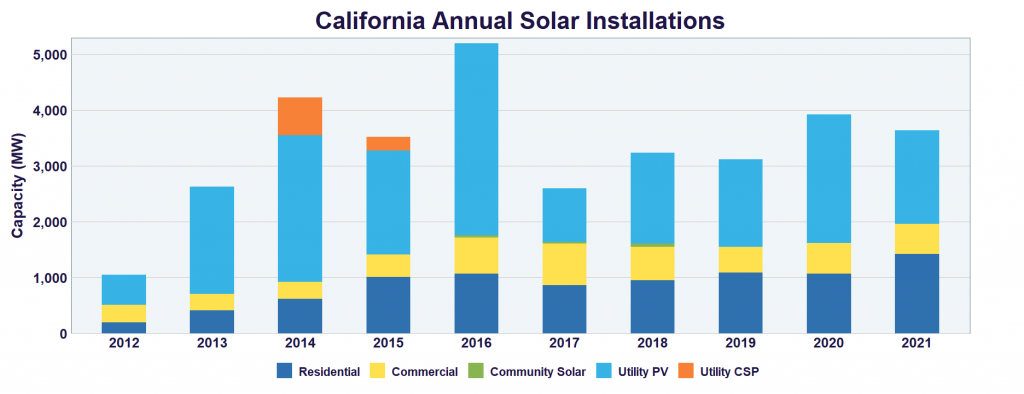

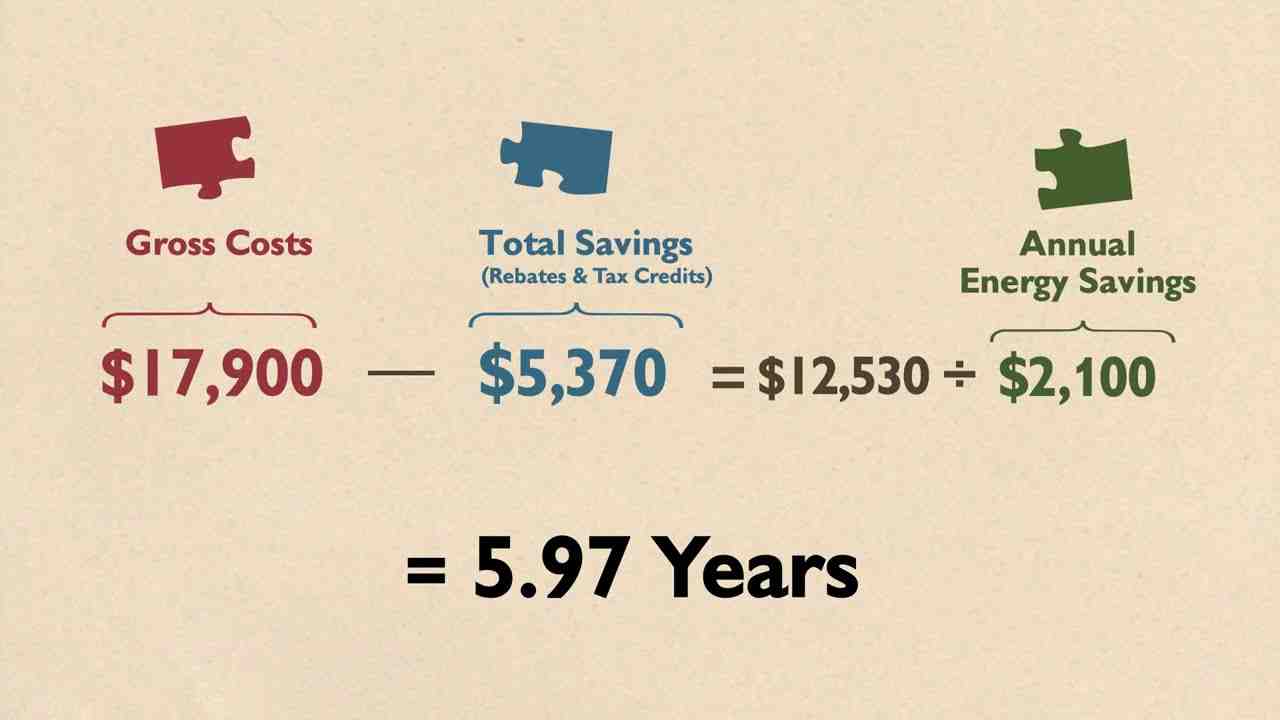

In most situations, solar energy pays off in California. This incredibly sunny state provides more than enough sun to pay for solar energy, and that doesn’t even take into account the numerous rebates and redemption rates. In addition, the repayment period is under six years, one of the lowest in the entire country.

Is solar energy expensive?

However, there is a broad consensus that solar electricity is expensive. The US DOE’s Energy Information Administration (EIA) estimates that this is the most expensive form of electricity among current technologies for new electricity production, about $ 396 per megawatt-hour for PV.

Is solar energy cheap or expensive? The report follows the conclusion of the International Energy Agency (IEA) in its 2020 World Energy Review that solar energy is now the cheapest electricity in history. The technology is cheaper than coal and gas in most large countries, prospects show.

Is solar energy really expensive?

Yes, solar panels are expensive. With a typical 6 kW system costing an average of $ 17,700 without incentives, they are home improvements that require significant financial investment.

Does solar energy cost a lot of money?

Solar Energy Costs for Homeowners The average starting price of a residential solar system is between $ 3,500 and $ 16,000. Why a huge range of costs? Well, a lot of variation depends on the size of the system you want to install and the types of panels you want to use.

Is solar really cheaper than electricity?

Although solar energy initially costs procurement and installation, people believe that solar energy is much cheaper than electricity in the long run due to rising electricity prices.

Is it worth the cost to go solar?

If you live in an area with high energy prices and a proper solar rating and can afford an initial investment, it is worth installing solar panels in your home while a 26% tax credit is in effect – for the benefit of the environment and your wallet. But don’t expect to eliminate your electricity bill overnight.

Does CA offer tax credit for solar?

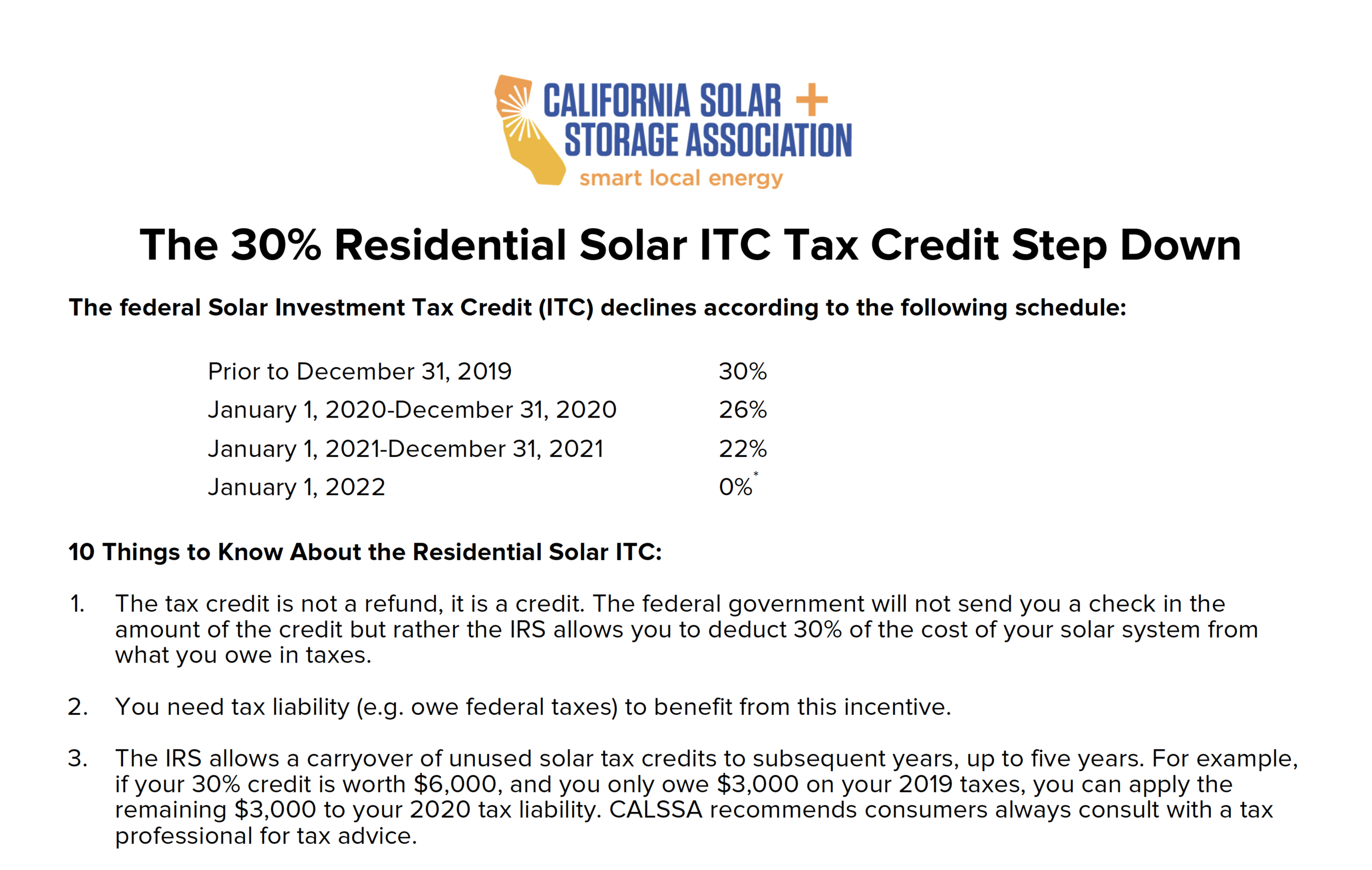

Federal Solar Investment Tax Credit Most California residents are eligible for the Federal Solar Investment Tax Credit — also known as the ITC. Adopted in 2005 by the Energy Policy Act, ITC initially covered up to 30% of the cost of installing solar panel systems.

Is there a California tax credit for solar energy? Solar Incentives, Tax Credits, and California Discounts * A 26% federal tax credit is available for purchased home solar systems installed through December 31, 2022. Excluding property value-added tax from the rooftop solar system.

Does California offer any incentives for solar?

The California Affordable Single Family Home (SASH) program provides incentives to qualified low-income single-home homeowners to help them meet the initial costs of installing solar energy.

Are there California incentives for solar panels?

Qualified low-income households can receive a one-time advance, based on capacity, incentive of $ 3,000 for each kW of solar energy installed in the house. To qualify for SASH, a home must receive an electrical service from PG&E, SCE or SDG & E and be occupied by the homeowner / applicant.

Does California have a solar tax credit 2020?

Investment Tax Credit (ITC) approves 26% of the cost of purchasing your solar system to homeowners before 2020. By installing the solar system in 2020, a maximum credit of 26% of the solar tax in California is approved before it is reduced to 22% in 2021.

Can you get free solar in California?

Accessibility and accessibility. By combining fixed, advance, capacity-based discounts with nonprofit administration, the SASH program enables qualified homeowners to obtain solar energy at no initial cost and without running costs, meaning they reap the full financial benefits of the system.

Does California have a solar tax credit 2021?

One of the biggest incentives available to homeowners in California is the Federal Investment Tax Credit (ITC). From now until 2021, the federal government is offering a 26% tax credit for investments in relation to the total price of a home solar system. In 2021, the value of the tax credit will be reduced to 22%.

What is the California tax credit for solar in 2021?

In 2021, this tax credit is estimated at 26% of the purchase of solar panels and qualified energy storage devices.

Does California have tax credit for solar?

Federal Solar Investment Tax Credit Most California residents are eligible for the Federal Solar Investment Tax Credit – also known as the ITC. Adopted in 2005 by the Energy Policy Act, ITC initially covered up to 30% of the cost of installing solar panel systems.

Is solar worth it in California 2021?

Are Solar Panels Worth It In California? As a general rule, solar energy pays off in California. Investor-owned utility companies are implementing buyout programs that are almost retail, and other rebates include low-income family incentives.

Is interest on solar loan tax deductible?

Unlike secured loans, interest on unsecured solar loans is not taxable.

What interest on the loan is deductible from taxes? Types of tax-deductible interest rates include mortgage interest rates on both first and second (home equity) mortgages, mortgages on investment property, interest on student loans, and interest on some business loans, including business credit cards.

Is interest on secured solar loan tax deductible?

Solar Loan Options Secured solar loans require you to secure some type of collateral, usually your house. Secured loans are less risky for the lender, so they generally have lower credit score requirements and lower interest rates. In most cases, the interest you pay on the secured loan is tax deductible.

Is interest on a secured loan tax deductible?

You can deduct interest on your mortgage if: you submit an IRS 1040 form and state your deductions; The mortgage is secured at your home, ie it is not a personal loan.

Is a solar loan a secured loan?

There are two basic types of solar credits; insured and uninsured. The key difference between the two is that secured solar loans use your house as collateral, while unsecured loans use the solar panels themselves as collateral. Secured solar loans also usually come with lower interest rates than unsecured loans.

What expenses qualify for solar tax credit?

Installation costs, including permit fees, inspection costs, and developer fees. Any and all additional solar equipment, such as inverters, wiring and mounting hardware. Home batteries charged with your solar equipment. Sales taxes on eligible costs.

Can I write off my solar loan interest?

Yes, you may be able to claim interest as a deduction per item if you have financed this home improvement. A qualifying loan is one that is taken to add “capital improvements” to your home, which means that the improvement must increase the value of your home, adapt it to new use, or extend its lifespan.

Does a solar loan affect debt-to-income ratio?

If you are currently financing your solar panels, all payments must be included in your debt-to-income ratio.

Can solar panels be written off on taxes?

You can qualify for the ITC for the tax year in which you installed the solar panels as long as the system produces electricity for the home in the United States. In 2021, ITC will provide a tax credit of 26% for systems installed between 2020 and 2022 and 22% for systems installed in 2023.

Does a solar loan count as debt?

If the solar equipment was purchased with an installment loan or a 2nd mortgage, the debt must be included in the DTI unless the debt is repaid. Some homeowners choose to include their solar panel debt in refinancing cash to do just that.

Is a solar loan secured or unsecured?

There are two basic types of solar credits; insured and uninsured. The key difference between the two is that secured solar loans use your house as collateral, while unsecured loans use the solar panels themselves as collateral. Secured solar loans also usually come with lower interest rates than unsecured loans.

Is a solar loan a personal loan?

Solar loans are unsecured personal loans with a fixed interest rate and terms of two to seven years. Their short repayment deadlines allow you to repay the debt sooner. Here are five lenders offering unsecured solar loans, as well as details on other financing options.

Does a solar loan count as debt?

If the solar equipment was purchased with an installment loan or a 2nd mortgage, the debt must be included in the DTI unless the debt is repaid. Some homeowners choose to include their solar panel debt in refinancing cash to do just that.

How can I get out of a solar loan?

The redemption method requires you to pay in advance the rest of what you owe under the solar lease. You can then remove the solar panels or use the system yourself. Most solar rental companies include a redemption price and period in your contract, so at least they won’t invent a number in progress.