Does California offer any incentives for solar?

Currently, California offers a statewide grid metering incentive for homeowners with solar panels, but the exact amount you receive will vary based on your local utility company.

Can you get free solar energy in California? Accessibility and affordability. By combining fixed, upfront capacity-based discounts with non-profit administration, the SASH program enables eligible homeowners to get solar power with no upfront costs and no ongoing charges, meaning they get the full financial benefits of it. system can be used.

Does California have a solar tax credit 2020?

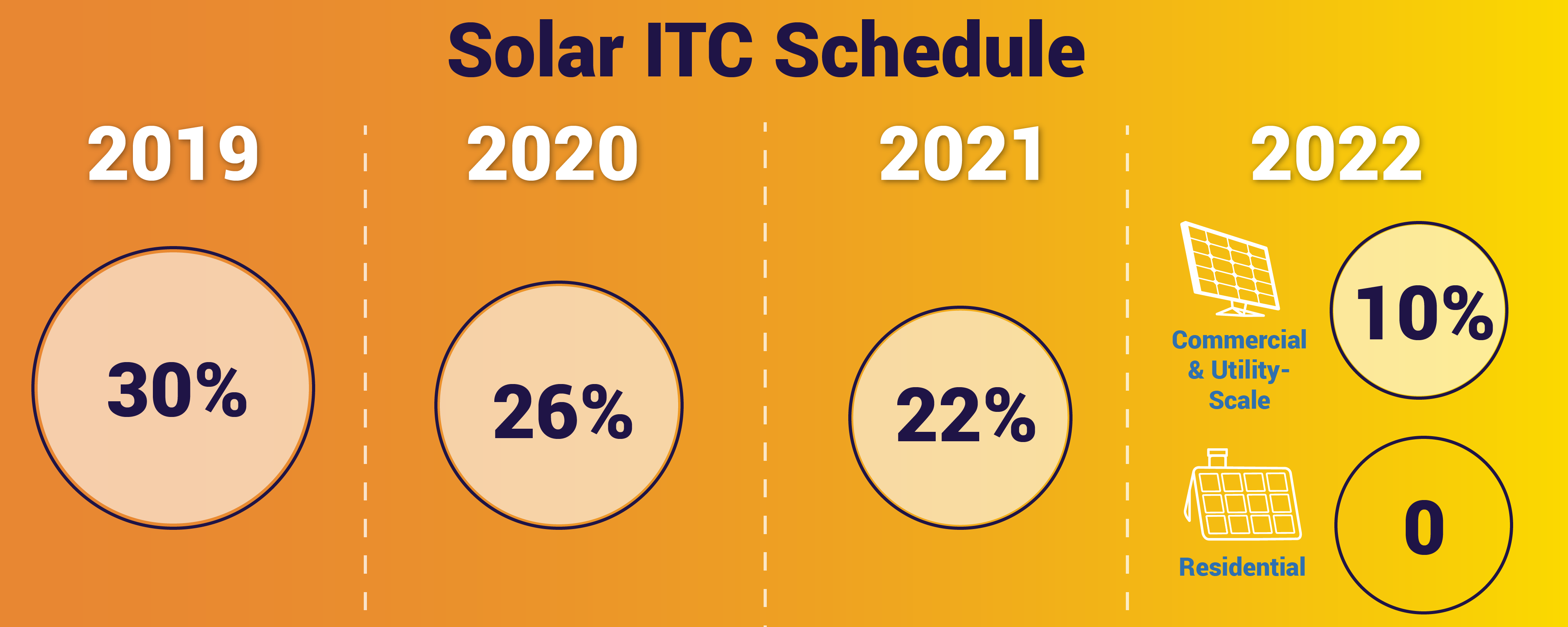

The Investment Tax Credit (ITC) grants an amount of 26% of the purchase costs of your solar system to homeowners for 2020. If a solar system is installed in 2020, you will get the maximum California solar tax credit of 26% before going back to 22% in 2021.

Does California have a solar tax credit for 2021?

2021 is the last year you can take advantage of the solar investment deduction (ITC) for residential solar installations. Systems installed in 2021 are eligible for a 22% federal tax credit. The credit applies to the costs of new solar panels, solar batteries, installation, assembly, permits and inspection.

Does California offer any incentives for solar?

California’s Single-Family Affordable Solar Housing (SASH) program offers incentives to eligible low-income single-family homes to help offset the initial cost of installing solar.

How much of a tax credit do you get for going solar in California?

While California does not offer a statewide solar tax credit, all residents are eligible for the current federal solar tax credit. The solar tax credit is worth 26% of the value of the installed system and can be claimed on federal tax returns.

Are there California incentives for solar panels?

Qualifying low-income households can receive a one-time capacity-based incentive of $3,000 for every kW of solar installed in their home. To qualify for SASH, the home must receive electrical service from PG&E, SCE, or SDG&E and be occupied by the homeowner/applicant.

Is there a California tax credit for solar panels?

If you are a residential owner installing solar panels in California, you will receive a 26% tax credit on the purchase.

Does California have a solar tax credit 2021?

One of the biggest incentives for homeowners in California is the Federal Investment Tax Credit (ITC). From now until 2021, the federal government is offering a 26% investment deduction on the total cost of a home solar system. In 2021, the value of the tax credit will fall to 22%.

Does California have tax credit for solar?

Federal Solar Investment Tax Credit Most California residents are eligible for the Federal Solar Investment Tax Credit, also known as the ITC. The ITC, introduced in 2005 by the Energy Policy Act, originally covered up to 30% of the cost of installing a solar panel system.

How much of a tax credit do you get for going solar in California?

If you are a residential owner installing solar panels in California, you will receive a 26% tax credit on the purchase.

Is solar worth it in California 2021?

Are Solar Panels Worth It in California? As a general rule, solar is worth it in California. The investor-owned utilities run near-retail buyback programs, and other rebates include low-income family incentives.

How do I qualify for free solar in California?

Eligible applicants must have a household income that is 80 percent or less than the area’s median income, own and live in their home, receive electrical service from one of the three investor-owned utilities (PG&E, SCE, or SDG& ;E), and living in a home defined as “affordable housing” by California Public Utilities Code 2852.

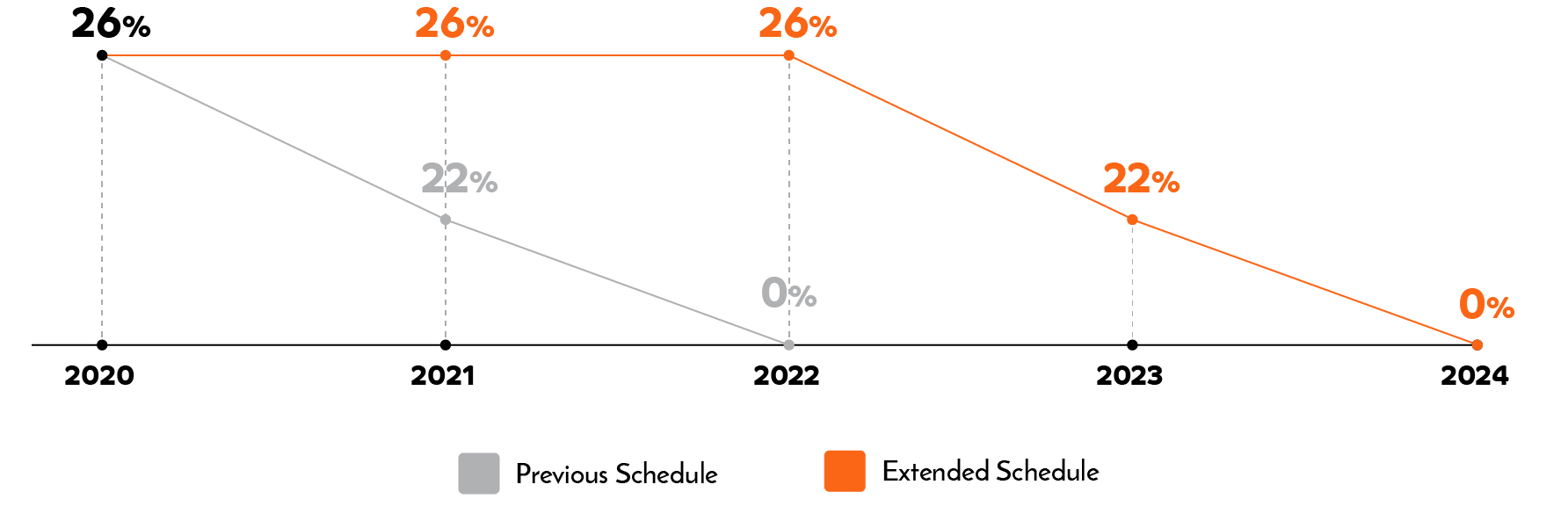

Does California Offer Solar Incentives? Learn the details of California Solar Incentives Buy and install a new home solar system in California in 2022, with or without a home battery, and you could qualify for the 26% federal tax credit. Residential ITC falls to 22% in 2023 and ends in 2024.

Does California offer free solar?

While California does not offer a statewide solar tax credit, all residents are eligible for the current federal solar tax credit. The solar tax credit is worth 26% of the value of the installed system and can be claimed on federal tax returns.

Does California pay for solar panels?

Most California residents are eligible for the Federal Solar Investment Tax Credit, also known as the ITC. The ITC, introduced in 2005 by the Energy Policy Act, originally covered up to 30% of the cost of installing a solar panel system.

Does California have a solar tax credit 2020?

The Investment Tax Credit (ITC) grants an amount of 26% of the purchase costs of your solar system to homeowners for 2020. If a solar system is installed in 2020, you will get the maximum California solar tax credit of 26% before going back to 22% in 2021.

Does California have a solar tax credit 2021?

One of the biggest incentives for homeowners in California is the Federal Investment Tax Credit (ITC). From now until 2021, the federal government is offering a 26% investment deduction on the total cost of a home solar system. In 2021, the value of the tax credit will fall to 22%.

How much of a tax credit do you get for going solar in California?

If you are a residential owner installing solar panels in California, you will receive a 26% tax credit on the purchase.

What is the California tax credit for solar in 2021?

In 2021, this tax credit will be valued at 26% of the purchase of solar panels and qualifying energy storage devices.

Is solar worth it in California 2021?

Are Solar Panels Worth It in California? As a general rule, solar is worth it in California. The investor-owned utilities run near-retail buyback programs, and other rebates include low-income family incentives.

How much of a tax credit do you get for going solar in California?

If you are a residential owner installing solar panels in California, you will receive a 26% tax credit on the purchase.

How much money do you get back from solar panels on taxes?

In December 2020, Congress approved an extension to the ITC, which provides a 26% tax credit for systems installed in 2020-2022 and 22% for systems installed in 2023. (Systems installed before December 31, 2019 were eligible for a 30% tax credit.)

Does California have a solar tax credit 2020?

The Investment Tax Credit (ITC) grants an amount of 26% of the purchase costs of your solar system to homeowners for 2020. If a solar system is installed in 2020, you will get the maximum California solar tax credit of 26% before going back to 22% in 2021.

What is the California tax credit for solar in 2021?

Homeowners who install solar panels in California receive a 26% tax credit on their purchase. It’s important to clarify here: there is no California-specific tax credit for solar.

Is it worth going solar in California?

In most situations, solar is worth it in California. This incredibly sunny state offers more than enough sun to make the cost of solar energy worth it, and that doesn’t even factor in the many discounts and repurchase rates. In addition, the payback period is less than six years, one of the lowest in the entire country.

Is there a downside to having solar energy? Disadvantages of solar include high upfront costs, the inability to work on any roof type, and it can be difficult to find a local installer depending on where you live.

Do you actually save money going solar?

With solar panels and solar panel systems, you save money and have your investment back in no time. Rising property values, lower energy costs and the federal tax credit all ease the initial cost of installing solar panels.

Is it really worth going solar?

Recently, the National Renewable Energy Laboratory (NREL) found that for a home with a solar energy system, every dollar saved in energy increases a home’s value by $20. That’s a 20-to-1 return on investment (ROI). Here are some factors to help you maximize the value of your solar investment.

Why am I not saving money with solar panels?

A few reasons a homeowner wouldn’t save money with solar power: Their roof size doesn’t allow for enough solar panels to offset their energy use. Their utility company has an unfriendly grid metering program, which means less savings for the homeowner. Too many beautiful trees shade their roofs.

How much money do you actually save from solar panels?

On average, US customers save about $1,500 a year by using solar energy – $37,500 over the course of 25 years. But for individual solar systems, these savings can range from $10,000 to $90,000, depending on roof size, sunlight exposure, local energy rates and solar incentives.

What is the average cost of solar in California?

The average cost of a solar panel installation in California ranges from $11,942 to $16,158. On a cost per watt ($/W) basis, a California solar panel installation ranges in price from $2.39 to $3.23. See how California compares to the cost of solar panels in the US.

How much do solar panels cost for a 2000 square foot house?

| House size (SF) | Average costs |

|---|---|

| 1,000 | $4,760 – $5,950 |

| 1500 | $7,140 – $8,925 |

| 2,000 | $9,520 – $11,900 |

| 2500 | $11,900 – $14,875 |

How much does a solar system cost in California 2021?

As of 2021, the average cost of solar panels in California is $2.73 per watt. This means that a 5 kW system would cost about $10,100 after the solar tax credit.

Does solar increase home value in California?

The research found that every watt of solar energy adds an average of $4 to the value of the home in California and an average of $3 per watt elsewhere. This equated to an average home sale price increase of $20,000 in California ($4 x 5,000 W for the average system size) and $15,000 outside of California ($3 x 5,000 W).

Does solar increase value of property?

Yes. The research shows that solar panels add about 4.1% to a home’s value – meaning you can earn tens of thousands of pounds. That also makes sense: who wouldn’t want to buy a home with better energy efficiency than the average home, which can save you money on your energy bill every month?

Do solar panels hurt the resale value of your home?

Installing solar panels in a home not only helps reduce current monthly utility bills; it could potentially increase the home’s value by up to 4.1% more than comparable homes without solar panels, according to recent solar research conducted by Zillow — or an additional $9,274 for the US-average value home.

Does solar add value to a home in CA?

At $4,020 per kilowatt, an installation of 5 kilowatts of solar panels would add an average of $20,100 to the market value of a mid-sized American home. Or in California at $5,911 per kilowatt, a small 3.1 kilowatt system would add an average of $18,324 to the value of a medium-sized home.