Since 2005, the federal government has incentivized homeowners to switch to solar through the solar investment tax credit (ITC), also known as the federal solar tax credit. Currently, this tax credit allows you to claim 26% of the total cost of installing your solar system on your federal taxes.

Will there be solar incentives in 2022?

Federal Solar Investment Tax Credit (ITC) ** Purchase and install a new home solar system in California in 2022, with or without a home battery, and you may qualify for the federal solar tax credit. ‘26%. The residential ITC drops to 22% in 2023 and ends in 2024.

Will the sun continue to be cheaper? The old question: Will solar panels be cheaper? Our quick answer for you is YES. Manufacturers have already made solar 80% cheaper since 2000 and will continue to lower the price further. However, ClimateBiz experts have recently found that the pace of price declines has slowed.

Will solar panels be cheaper next year?

The cost of going solar has dropped by about 80% from 2000 to 2020. While this price drop has had a major impact on the solar industry and the adoption of solar panels across the country, it is unlikely to continue to decline at such a rate.

Are solar panels a good investment in 2021?

Are solar panels worth it in 2021? The short answer: yes. Today’s roof solar systems are sleek and can integrate into the design of your home while allowing you to produce your own energy.

How much do solar panels save in 2021?

Due to the current Federal Tax Credit for renewable energy systems (26% of total system and installation costs) most customers will save more than $ 3,000 if they go solar in the 2021 or 2022. So the actual cost of the solar installation customer is (depending on the state) $ 10,000- $ 14,000 – a national average of $ 12,000.

Will solar panels get cheaper in the future?

Bloomberg and its 65 market specialists predict that overall, the cost of the sun will drop by about 34% by 2030. While it doesn’t quite match the 80% decline we’ve seen from 2000 to 2020, it shows that the cost of going solar is still moving downward.

Will solar tax credits increase 2021?

26% Solar Tax Credit Still Available By 2022 Back in December 2020, Congress extended the 26% federal tax credit to solar energy by the end of 2022. With the original phasing-out schedule, the solar tax credit was declining to 22% in 2021, and then to 10% for businesses only in 2022 (0% for homeowners).

Will Biden extend tax credits for solar?

President Biden Renewed Commitment to Expanding the Clean Energy Tax Credit in the State of the Union, Including Stand-Alone Energy Storage, which Can Increase Investment in Clean Energy.

Will solar tax credit be increased?

In December 2020, Congress passed an ITC extension, providing a 26% tax credit for systems installed in 2020-2022, and 22% for systems installed in 2023. (Systems installed before December 31, 2019 were eligible for a 30% tax credit.) The tax credit expires in 2024 unless Congress renews it.

How much is the federal solar tax credit for 2021?

Federal Investment Tax Credit (ITC) At the federal level, you qualify for the federal federal Investment Tax Credit (ITC). In 2021, the ITC will provide a 26% tax credit on the cost of installing your solar panels, as long as your taxable income is greater than the credit itself.

Is solar energy worth it in 2021?

Are solar panels worth it in 2021? The short answer: yes. Today’s roof solar systems are sleek and can integrate into the design of your home while allowing you to produce your own energy.

Is solar energy worth investing in?

Recently, the National Renewable Energy Laboratory (NREL) found that for a home with a solar power system, every dollar saved on energy increases the value of the home by $ 20. This is a 20-to-1 return on investment (ROI). Here are some factors to help you maximize the value of your solar investment.

Will solar panels get cheaper 2021?

Yes, but we see no additional benefit when we wait longer as most of the remaining cost components are difficult to convert. The Bloomberg New Energy Finance (BNEF) report projects that the price of the sun will fall by a third by 2030. That is, your $ 2.7 / Watt investment today will be $ 1.8 / Watt after ten years.

Why You Should Go solar in 2021?

Get a tax credit Homeowners or tenants who installed solar systems in 2019 and 2020 have become eligible for a federal tax credit for 30 percent and 26 percent solar investment, respectively. In 2021, the tax credit is 22 percent. The benefit could expire in 2022 unless the government decides to renew it.

Is there a government grant for solar panels?

There are no grants for solar panels in the traditional sense of the word from the Government to pay in full or in part for your solar panel installation.

Is there a government stimulus for solar panels? In December 2020, Congress passed an ITC extension, providing a 26% tax credit for systems installed in 2020-2022, and 22% for systems installed in 2023. (Systems installed before December 31, 2019 were eligible for a 30% tax credit.) The tax credit expires in 2024 unless Congress renews it.

Can I get free solar panels UK?

Can I get free solar panels in the UK? Companies have offered free solar panels in the past, but this service is no longer available in the UK. As solar panels become more affordable, the government has drastically reduced the Feed-In Tariff (FIT).

What is the criteria for free solar panels?

To qualify for free solar panels you must meet at least one of the following criteria:

- Over 70 years.

- One parent.

- Living with a child under the age of 18 with a registered illness or disability.

Are there any grants for solar panels UK?

There are no grants for solar panels available in the UK. The government used to provide interest-free loans and grants as part of the Green Deal, but it concluded in 2015. The Feed-in Tariff also came to an end in April 2019, but the new Intelligent Export Guarantee (SEC) started in January 2020.

How much money do you get back from solar panels UK?

Return on Investment for a 4 kW Solar Panel Installation The range will cost around £ 4,500 – 7,000 and will produce a Feed in Tariff return of around £ 79 a year. Combine this with energy savings of almost £ 170 a year along with your export tariff, then you will be looking at revenue and savings amounting to almost £ 300.

Does the government subsidize solar energy?

The MISI report found that non-hydroelectric renewable energy (primarily wind and solar) benefited from $ 158 billion in federal subsidies, or 16% of the total, mostly in the form of tax policy. and direct federal expenditure on research and development (R&D).

How does the government help solar energy?

The Solar Investment Tax Credit (ITC) is a federal tax incentive enacted into law to encourage the use of solar energy in the United States. This federal tax credit is claimed against the tax liability of residential, commercial, and utility-scale investors in solar energy projects.

How much does the government spend on solar subsidies?

The federal government spent a total of $ 45.8 billion on solar and wind tax incentives from 2005 to 2015. Of this, production tax credits included 46.4%, or $ 21.3 billion. Expenditure on 1603 Grants included $ 20.4 billion, or 44.5% of the total.

How much does the US government subsidize renewable energy?

Subsidies for renewable energy generation technologies account for about 20% of total subsidies in the energy sector (USD 128 billion), biofuels for about 6% (USD 38 billion) and nuclear for at least 3% (USD 21 billion).

Are there any government grants for solar panels UK?

There are no grants for solar panels available in the UK. The government used to provide interest-free loans and grants as part of the Green Deal, but it concluded in 2015. The Feed-in Tariff also came to an end in April 2019, but the new Intelligent Export Guarantee (SEC) started in January 2020.

Are solar panels legal in UK?

The good news is that here in the UK there is no planning permit requirement for solar panels. The government is keen for people to install them so that regulations are left intentionally lenient.

Does the UK government subsidies solar panels?

This year the answer is huge because of the viability of the ECO4 (Energy Company Obligation Scheme). Through ECO4, the government has allocated £ 4 billion for the installation of solar panels and heat pumps across the UK.

Can you claim solar tax credit every year?

You can claim the credit in the same year you complete the installation, so you can claim the full 26% tax refund if you install your system before the end of 2022.

How old can you claim the energy tax credit? You may be able to take out these credits if you have made an energy-saving upgrade to your main residence during the taxable year. In 2018, 2019 2020, and 2021 the residential energy property credit is limited to a total credit limit of $ 500 ($ 200 lifetime limit for windows).

How many times can you claim solar tax credit?

How often can you claim a solar tax credit? You can claim the solar tax credit only once for your solar power installation. If you have an unused remaining amount on your tax credit that you cannot claim in a single tax year, you may be able to carry that value of the tax credit for up to five years.

Can I claim solar tax credit twice?

Can You Claim Solar Tax Credit Twice? Owners can claim the solar tax credit only once on the same solar range. However, new additions or systems from the same owner may qualify for separate solar tax credits.

How many years can I claim solar tax credit?

You can claim the federal solar tax credit as long as you own a home in the United States and the solar panel system installed in a residence in the United States. The tax credit changes up to five years if the taxes you owe are less than the credit you earn.

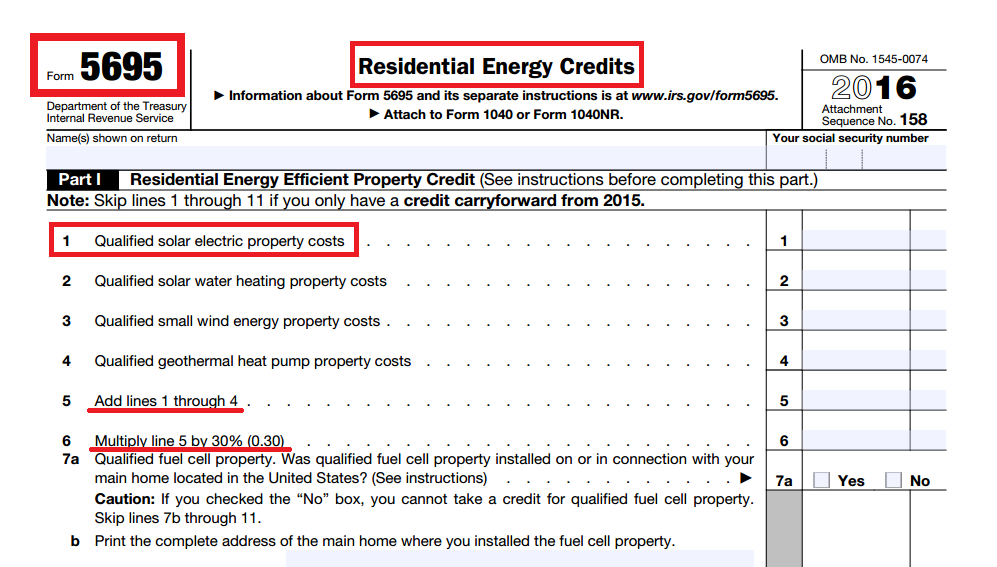

How does IRS verify solar credit?

Filing Requirements for a Solar Tax Credit To claim credit, you must file IRS Form 5695 as part of your tax return. You will calculate the credit on Part I of the form, and then enter the result on your 1040.

Do you get a tax credit every year for solar panels?

You may qualify for the ITC for the tax year in which you installed your solar panels as long as the system generates electricity for a home in the United States. In 2021, the ITC will provide a 26% tax credit for systems installed between 2020 and 2022, and 22% for systems installed in 2023.

How many years can you use the solar tax credit?

You can claim the federal solar tax credit as long as you own a home in the United States and the solar panel system installed in a residence in the United States. The tax credit changes up to five years if the taxes you owe are less than the credit you earn.

How does solar tax credit work if I get a refund?

If you paid $ 5,000 and your tax refund is $ 3,000, you now pay only $ 2,000 in taxes. You cancel the $ 2,000 solar tax credit and add it to your refund check. The remaining $ 1,000 solar tax credit will be deducted from next year’s taxes or whatever year you want again.