Do solar panels Increase Home value?

Installing solar panels in a home not only helps reduce ongoing monthly utility bills; According to recent solar research by Zillow, it can add up to 4.1% more home value than comparable homes without solar panels — or an additional $9,274 for the average valued home in the US.

Are solar panels a good investment in 2021? Are solar panels worth it in 2021? The short answer: yes. Today’s rooftop solar systems are elegant and can be integrated into the design of your home while still allowing you to produce your own energy.

How much do solar panels save in 2021?

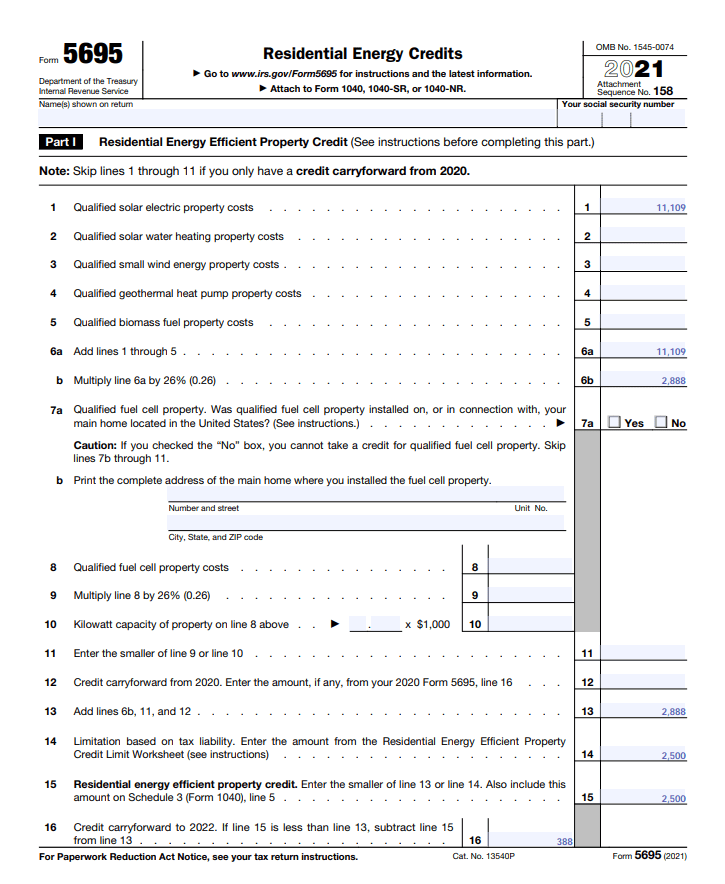

Because of the current federal tax credit for renewable energy systems (26% of total system and installation costs), most customers will save over $3,000 by switching to solar in 2021 or 2022. So the actual customer cost of installing solar panels is between $10,000 and $14,000 (depending on the state) — a national average of $12,000.

What is the cost of solar energy in 2021?

According to a recent report from the Solar Energy Industries Association, the national average cost of a residential solar installation was $2.94 per watt in the first quarter of 2021.

Do you actually save money going solar?

Solar panels not only help the environment by reducing greenhouse gas emissions, but allow you to keep more money in your bank account every month. You’ll save by using less electricity, a saving that kicks into high gear once you’ve cut enough electricity bills to recoup installation costs.

Will solar panels get cheaper in the future?

Bloomberg and its 65 market specialists forecast that overall solar costs will fall by about 34% by 2030. While that’s not quite the 80% drop we saw from 2000 to 2020, it shows that the cost of switching to solar is still falling in a downward direction.

Why You Should Go solar in 2021?

Better Access to Solar Energy The cost of solar panels and their installation has been falling recently. In addition, solar systems are more durable and therefore even more efficient. Instead of paying money for traditional electricity bills, be smart and go for solar energy.

What is the solar credit for 2021?

You may qualify for ITC for the tax year in which you installed your solar panels as long as the system is generating electricity for a home in the United States. In 2021, the ITC will provide a 26% tax credit for systems installed between 2020 and 2022 and 22% for systems installed in 2023.

Is it really worth going solar?

Recently, the National Renewable Energy Laboratory (NREL) found that for a home with solar power, every dollar saved in energy adds $20 to the home’s value. That’s a 20 to 1 return on investment (ROI). Here are some factors to help you maximize the value of your solar investment.

Why you should go solar now?

One of the most tangible and important reasons to switch to solar energy is to reduce energy costs. The electricity that a solar system produces offsets your electricity consumption, significantly reducing or in some cases even eliminating your electricity bill, allowing you to spend money elsewhere or save the difference.

Do solar panels really increase home value?

Installing solar panels in a home not only helps reduce ongoing monthly utility bills; it can potentially add up to 4.1% more value to the home than comparable homes without solar panels, according to recent solar research from Zillow — or an additional $9,274 for the average valued home in the US.

Why is solar not popular in Arizona?

Political climate For years there has been a nasty public dispute between the solar industry, energy suppliers and the country’s government over net metering, which some experts have cited as the cause of the decline in solar installations in the country.

Is solar worth it in Arizona 2021?

So, is solar worth it in AZ? Yes, solar panels are totally worth it in Arizona. Solar panels can increase the value of your home by 2-3% A-Z, save you up to 100% on electricity and much more! Arizona has more sunny days than any other state, and the federal government pays 30% of the cost.

Is solar in Arizona worth it?

The quick answer is yes, solar is worth it in Arizona. In recent years, solar systems have become around 40% cheaper across the board. However, this is not at the expense of their performance and quality. These systems are now much more effective and allow you to make significant savings on your electricity bill.

How many years can you claim solar tax credit?

You can claim the federal solar tax credit as long as you are a US homeowner and own the solar panel system installed in a United States residence. The tax credit extends for up to five years if the taxes you owe are less than the credit you earn.

Can you claim the solar tax deduction more than once? How often can you claim the solar tax deduction? You can only claim the solar tax deduction once for your solar power system. If you have unused amounts on your tax credit that you cannot claim in a single tax year, you may be able to carry over that tax credit value for up to five years.

Is the solar tax credit a one time credit?

The Solar ITC is currently a one-time loan. However, one of the coolest features is that you can roll over the surplus to next year if you can’t use it in full when you submit it. For example, imagine you only owed $5,000 in taxes but received the $5,200 solar loan from the previous example.

Can you claim solar tax credit every year?

You can claim the credit in the same year that you complete the installation, allowing you to claim the full 26% tax refund if you install your system before the end of 2022.

Is solar energy a one time payment?

You pay the solar company a fixed monthly rate. This rate is calculated based on the estimated amount of electricity your modules will generate over their lifetime. With solar PPAs, your solar bills are based on the actual electricity produced by your solar system, so your solar bill may vary from month to month.

How does the solar 26% tax credit work?

With the investment deduction (ITK), also known as the federal solar deduction, you can deduct 26 percent of the cost of installing a solar system from your federal taxes. The ITC applies to both residential and commercial systems and there is no upper limit to its value.

Can you claim solar tax credit every year?

You can claim the credit in the same year that you complete the installation, allowing you to claim the full 26% tax refund if you install your system before the end of 2022.

Do you get a tax credit every year for solar panels?

You may qualify for ITC for the tax year in which you installed your solar panels as long as the system is generating electricity for a home in the United States. In 2021, the ITC will provide a 26% tax credit for systems installed between 2020 and 2022 and 22% for systems installed in 2023.

How many years can you claim the energy tax credit?

You may be able to claim these credits if you made energy improvements to your primary residence during the tax year. In 2018, 2019, 2020 and 2021, the home loan is capped at a lifetime total credit limit of $500 ($200 lifetime limit for windows).

Can you claim multiple solar tax credits?

7. Can the solar tax deduction be claimed twice? You can’t technically claim the solar tax deduction twice if you own a home; However, you can roll over any unused balance to the next tax year for up to five years. Note: If you own more than one home powered by solar energy, you may be eligible.

Is the solar tax credit a refund?

The solar investment tax credit is non-refundable, so you must have sufficient solar tax liabilities to receive the full value of this tax credit. However, there are options if you don’t have enough solar tax debt in a single tax year.

How does the solar tax credit work if I get a refund? If you paid $5,000 and your tax refund is $3,000, you now only paid $2,000 in taxes. Your solar tax credit will erase that $2,000 and add it to your refund check. The remaining $1,000 solar tax credit will be deducted from next year’s taxes, or whatever year you owe again.

Is the 26% solar tax credit refundable?

The 26 percent ITC is non-refundable. However, according to Section 48 of the Internal Revenue Code, the ITC can be carried forward for up to five years. So if you’re taxable next year but not this year, you can still claim the credit.

How does the solar 26% tax credit work?

If you install a solar system in 2021 or 2022, 26% of your total project cost (including equipment, permits, and installation) can be claimed as a credit on your federal tax return. If you spend $10,000 on your system, you owe $2,600 less in taxes the following year.

Are solar tax credits refundable?

Is the solar ITC refundable? The Solar ITC is a non-refundable credit—it can only be used against your organization’s US federal income tax liability.

Has the 26% solar tax credit been extended?

Under the new Congressional Act, the 26% solar tax credit will remain available through 2021 and 2022. In addition, the 22% and 10% reductions have been postponed to 2023 and 2024, respectively. In addition to being low cost and low environmental impact, solar energy has created many jobs in the US economy.

Is the 2020 solar tax credit refundable?

This is a non-refundable tax credit, which means you will not receive a tax refund for the amount of the tax credit that exceeds your tax liability. Homeowners can get a tax refund from the tax credit at the end of the year if the reduction in tax liability results in an overpayment during the year.

Are solar tax credits refundable?

Is the solar ITC refundable? The Solar ITC is a non-refundable credit—it can only be used against your organization’s US federal income tax liability.

How does the solar tax refund work?

If you install a solar system in 2021 or 2022, 26% of your total project cost (including equipment, permits, and installation) can be claimed as a credit on your federal tax return. If you spend $10,000 on your system, you owe $2,600 less in taxes the following year.

What are refundable credits for 2020?

The 2020 Child Tax Credit For example, if you have three children, ages 14, 12, and 9, you can claim the credit for each of them—a total of $6,000. A family with six eligible children could receive $12,000 in credit. The Child Tax Credit is an example of a partially refundable tax credit.

Is the solar tax credit a refundable credit?

Is the solar ITC refundable? The Solar ITC is a non-refundable credit—it can only be used against your organization’s US federal income tax liability.

How does the solar tax refund work?

If you install a solar system in 2021 or 2022, 26% of your total project cost (including equipment, permits, and installation) can be claimed as a credit on your federal tax return. If you spend $10,000 on your system, you owe $2,600 less in taxes the following year.

Is solar tax credit a refund?

This is a non-refundable tax credit. H. You will not receive a tax refund for the amount of the solar tax credit that exceeds your tax liability. However, you can carry over an unused amount of the solar tax deduction to the next tax year.