If you paid $ 5,000 and your tax refund is $ 3,000, you have now only paid $ 2,000 in taxes. Your solar tax deduction cancels this $ 2,000 and adds it to your refund check. The remaining $ 1,000 solar tax deduction will be deducted from next year’s taxes or which year you owe again.

Why am I not getting my full solar tax credit?

Your system must be installed in either your primary or secondary residence. You must own the photovoltaic system, regardless of whether you have paid in advance or financed the costs. (If you lease your solar system, you will not retain the right to claim the tax deduction.)

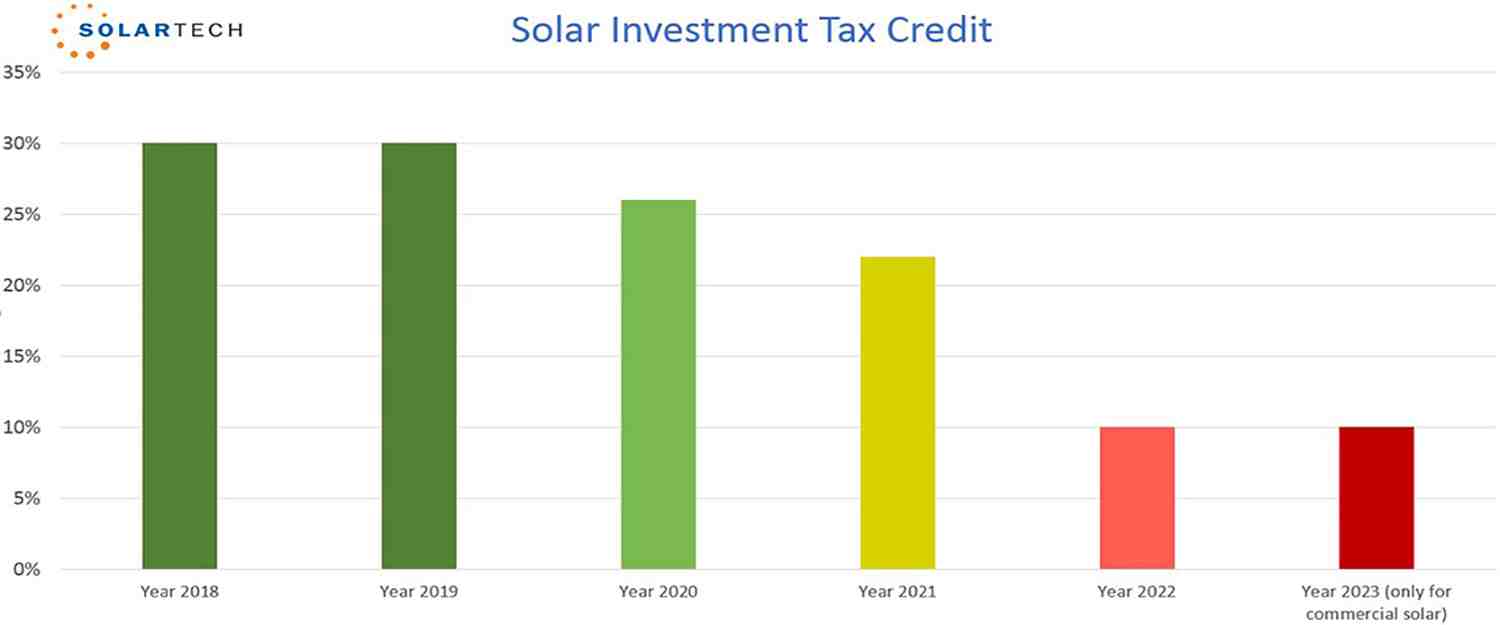

How much do you get back in tax for solar panels? Solar Tax Deduction Installing renewable energy equipment in your home can qualify you for a credit of up to 30% of your total cost.

How many times can you claim the solar tax credit?

How many times can you claim the solar tax deduction? You can only claim the photovoltaic tax deduction once for your photovoltaic system. If you have an unused amount left on your tax deduction that you cannot claim in a single tax year, you may be able to carry over that tax deduction value for up to five years.

Is the solar tax credit a one time credit?

Currently, solar energy ITC is a one-time credit. However, one of its coolest features is that you can transfer the profits to next year if you can not use it all when archiving. For example, suppose you only owed $ 5,000 in taxes but received $ 5,200 in your home solar credit from the previous example.

How many years can you claim solar tax credit?

You can claim the federal solar cell tax deduction as long as you are a U.S. homeowner and own the solar panel system installed in a home in the United States. The tax deduction rolls over for up to five years if the tax you owe is less than the credit you earn.

Can you claim solar tax credit every year?

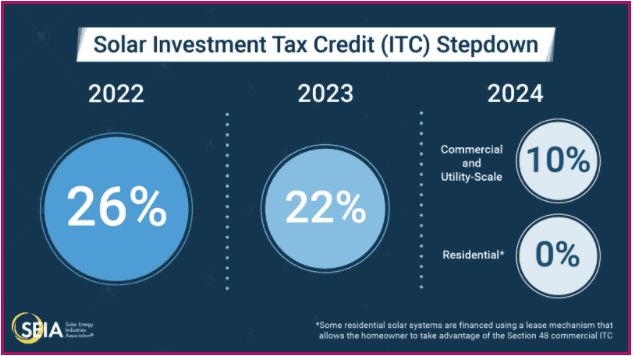

You can claim the credit the same year you complete the installation, so you can claim the full 26% tax refund if you install your system before the end of the year 2022.

How do you get the 26% tax credit for solar?

How do I claim the federal solar cell tax deduction? After applying for professional tax advice and ensuring you are eligible for the credit, you can complete and attach IRS Form 5695 to your federal tax return (Form 1040 or Form 1040NR).

How much is a 26% tax credit?

A 26% credit will save you $ 5,200 on your federal returns. The tax deduction rolls over year after year if the tax you owe is less than the credit you earn.

How does the 26 solar tax credit work?

Federal Solar Tax Credit – December 2021 Update When you install a solar cell system in 2021 or 2022, 26% of your total project costs (including equipment, permit, and installation) may be claimed as a credit on your federal tax return. If you spend $ 10,000 on your system, you owe $ 2,600 less in taxes the following year.

How do I get the solar tax credit benefit?

To claim the credit, you must file IRS Form 5695 as part of your tax return. You calculate the credit on Part I of the form and then enter the result on your 1040.

Will solar tax credit increase my refund?

Unfortunately not. Instead, the ITC amount is used against your tax liability or the money you owe the IRS at the time of income tax. So even though solar energy ITC directly reduces the amount you have to pay Uncle Sam dollar for dollar, it does not put money back in your pocket that you might have intended.

How does the solar tax refund work?

When you install a photovoltaic system in 2021 or 2022, 26% of your total project costs (including equipment, permits, and installation) may be claimed as a credit on your federal tax return. If you spend $ 10,000 on your system, you owe $ 2,600 less in taxes the following year.

How much do you get back in taxes for solar panels?

In December 2020, Congress passed an extension of the ITC, which provides a tax deduction of 26% for systems installed in 2020-2022 and 22% for systems installed in 2023. (Systems installed before December 31, 2019 were eligible for a 30% tax deduction.)

How many years can you claim the energy tax credit?

You may be able to take out these credits if you have made energy-saving improvements to your main home during the tax year. In 2018, 2019 2020 and 2021, the credit for residential energy properties is limited to a total lifetime credit limit of $ 500 (lifetime limit of $ 200 for windows).

How long is a tax deduction good for? Non-refundable tax deductions are only valid in the reporting year, expire after the filing of the report and cannot be carried forward to future years. 1 Because of this, non-refundable tax deductions can have a negative impact on low-income taxpayers as they are often unable to use the entire credit.

Can I claim energy tax credit for previous years?

This means that you can not only claim the credit on your 2021 or previous years tax returns (2017 – 2020), you can also claim it on your 2022 – 2023 federal tax return through reduced amounts.

How many years does the energy credit carry forward?

Energy Efficiency Credits With Residential Energy Efficient Property Credit, taxpayers can carry forward the unused portion of the credit from this year’s tax return to next year’s tax return. For Non-Business Energy Property Credit, the carryover period is 20 years.

Is residential energy credit carryforward?

The basics: You can carry forward the energy efficiency tax deduction to future years if you use a geothermal pump, solar panels, solar heater, a small wind energy system or fuel cells. Energy incentives will be updated as the IRS issues additional guidance.

Can I claim a tax credit from previous years?

You have three years to file and claim a refund from the due date of your tax return. If you were eligible, you can still claim the EITC for previous years: For 2020, if you submit your tax return by 17 May 2024. For 2019, if you submit your tax return by 15 July 2023.

How many years does the energy credit carry forward?

Energy Efficiency Credits With Residential Energy Efficient Property Credit, taxpayers can carry forward the unused portion of the credit from this year’s tax return to next year’s tax return. For Non-Business Energy Property Credit, the carryover period is 20 years.

How long can you carry forward solar tax credit?

However, the solar cell ITC can be traced back one year and up to 20 years for companies that do not have sufficient tax liability to set off against the tax year in which their solar energy system was put into operation.

What is energy credit carryforward?

Also use form 5695 to transfer any energy efficient real estate loan to homes from 2020 or to transfer the unused portion of the credit to 2022. Who can take the credit. You may be able to take the credits if you made energy-saving improvements to your home in the United States in 2021. Home.

How many times can you claim solar tax credit?

How many times can you claim the solar tax deduction? You can only claim the photovoltaic tax deduction once for your photovoltaic system. If you have an unused amount left on your tax deduction that you cannot claim in a single tax year, you may be able to carry over that tax deduction value for up to five years.

How many years can you claim solar?

You can claim the federal solar cell tax deduction as long as you are a U.S. homeowner and own the solar panel system installed in a home in the United States. The tax deduction rolls over for up to five years if the tax you owe is less than the credit you earn.

Is the solar tax credit a one time credit?

Currently, solar energy ITC is a one-time credit. However, one of its coolest features is that you can transfer the profits to next year if you can not use it all when archiving. For example, suppose you only owed $ 5,000 in taxes but received $ 5,200 in your home solar credit from the previous example.

Can you claim solar tax credit every year?

You can claim the credit the same year you complete the installation, so you can claim the full 26% tax refund if you install your system before the end of the year 2022.

What was the 3rd stimulus check amount?

The third round of stimulus payments is worth up to $ 1,400 per. person. A married couple with two children can, for example, receive a maximum of DKK 5,600. Families are allowed to receive up to $ 1,400 for each relative regardless of age. Previous rounds limited payments to relatives under 17 years of age.

How much was the 3rd stimulus check per. child? Below are ten things you need to know about the third round of payments – including information on filing your 2021 tax if you missed one or more of your payments: 1. Payments were $ 1,400 per month. qualified adult ($ 2,800 for married taxpayers filing a joint statement) and $ 1,400 per. relatives.

How much was the 3rd stimulus check for dependents?

The amount of the third economic impact payment is $ 1,400 for each qualifying provider with a valid CPR or Adoption Taxpayer Identification Number issued by the IRS.

How much will dependents get on 3rd stimulus?

Eligible families can receive $ 1,400 per person. breadwinner so that an average family of four (two parents and two breadwinners) could receive a total of $ 5,600.

Do dependents get the third stimulus check?

For the third stimulus check, all your relatives, regardless of age, qualify. This means that for every child or adult you have, you can claim an additional $ 1,400. This is different from the first and second stimulus checks, which only allowed children (under 17) to get the extra payment.