What are the 2 main disadvantages of solar energy?

Disadvantages of solar energy

- Cost. The initial cost of buying a photovoltaic system is quite high. …

- Weather dependent. Although solar energy can still be collected during cloudy and rainy days, the efficiency of the solar system decreases. …

- Solar energy storage is expensive. …

- Uses a lot of space. …

- Associated with pollution.

What are the 2 pros and cons of solar energy? Yes, there are many benefits to solar energy, such as its ability to lower your CO2 footprint and reduce the load on the power grid. However, admittedly, solar energy also has its limitations, such as the inability to generate electricity at night and the difficulty of moving solar panels once installed.

What is the main disadvantage of solar energy?

Reliability. A disadvantage of solar energy is that it is dependent on the sun, electricity can not be generated during the night, which requires you to either store excess energy made during the day, or connect to an alternative power source, such as the local elnet.

What is the disadvantage of solar energy Why?

High initial costs for materials and installation and long ROI (but with the reduction in the cost of solar energy over the last 10 years, solar energy is becoming more cost effective for every day) Requires plenty of space as efficiency is not 100% yet. No solar energy at night, so a large battery bank is needed.

What are the 5 disadvantages of solar energy?

High initial costs for materials and installation and long ROI (but with the reduction in the cost of solar energy over the last 10 years, solar energy is becoming more cost effective for every day) Requires plenty of space as efficiency is not 100% yet. No solar energy at night, so a large battery bank is needed.

What are 5 Advantages and disadvantages of solar?

| Benefits of solar energy | Disadvantages of solar energy |

|---|---|

| Reduces the electricity bill | High start-up costs |

| Provides tax incentives | Time consuming |

| Paired with Solar Battery Storage | Weather dependent |

| Environmentally friendly | Strict criteria |

How do I get the 2021 solar tax credit in California?

To be eligible for the federal tax deduction, homeowners must meet the following criteria: You have installed a residential solar panel system at any time from 2006 to the end of 2022. You have placed the solar panel system in a residential area. It does not have to be your primary residence.

How do I claim my solar cell tax deduction in California? It is easy to claim ITC. All you have to do is fill out IRS Form 5695, “Residential Energy Credits.” Form 5695 calculates tax deductions for a range of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines and fuel cells.

Does CA allow solar tax credit?

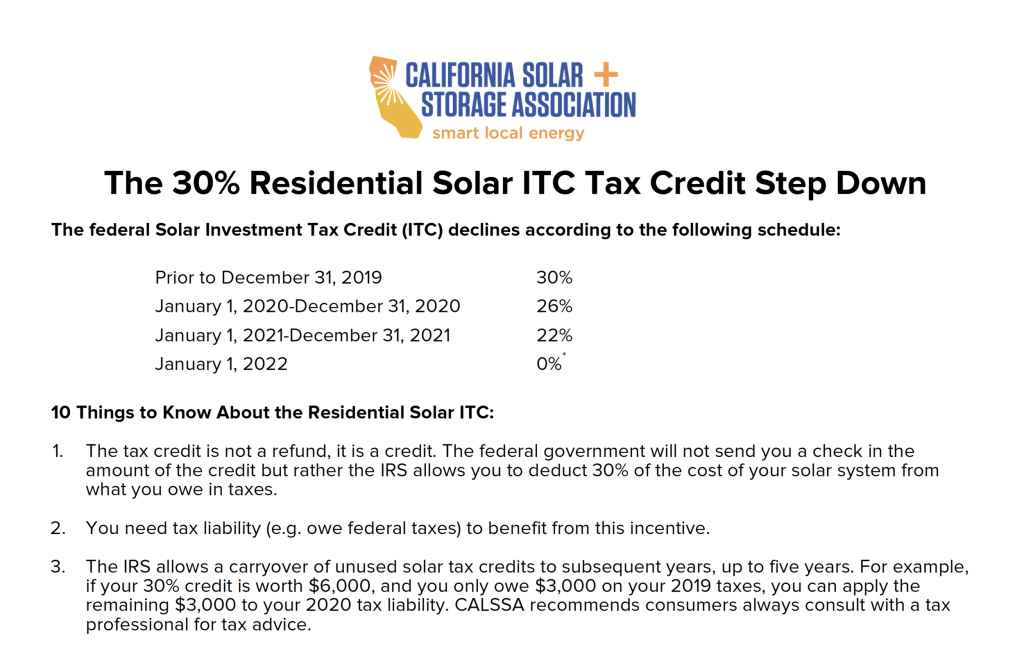

Federal Solar Investment Tax Credit Most California residents are eligible to receive Federal Solar Investment Tax Credit – also known as ITC. The ITC was adopted in 2005 by the Energy Policy Act and initially covered up to 30% of the cost of installing a solar panel system.

How does solar tax credit work in California?

If a photovoltaic system is commissioned in 2022, you will be entitled to a tax deduction of 26% instead of 22%. You must purchase the system to claim ITC. Consumers can not claim the tax deduction for leases or Power Purchase Agreements (PPA).

Does California have a solar tax credit 2020?

The Investment Tax Credit (ITC) provides an amount of 26% of the purchase price of your solar system to homeowners before 2020. Having a solar energy system installed in 2020 provides the maximum 26% California solar tax deduction before being scaled down to 22% in 2021.

Does California have a solar tax credit 2021?

One of the largest incentives available to homeowners in California is the Federal Investment Tax Credit (ITC). From now until 2021, the federal government will offer a 26% investment tax deduction against the total cost of a home solar system. In 2021, the value of the tax deduction will fall to 22%.

How do I claim solar tax credit?

Filing Solutions for Solar Tax Deductions To claim the credit, you must file IRS Form 5695 as part of your tax return. You calculate the credit on Part I of the form and then enter the result on your 1040.

When can you claim solar tax credit?

In general, you can claim a tax deduction for the expenses associated with the new photovoltaic system that was already installed on the house for the year you moved into the house (provided the developer did not claim the tax deduction) – in other words, you can claim on credit in 2021.

How do I claim solar tax credit for 2020?

How do I claim the federal solar cell tax deduction? After applying for professional tax advice and ensuring you are eligible for the credit, you can complete and attach IRS Form 5695 to your federal tax return (Form 1040 or Form 1040NR).

How does the federal solar tax credit work 2021?

You can qualify for ITC for the tax year in which you installed your solar panels, as long as the system generates electricity for a home in the United States. In 2021, the ITC will provide a tax deduction of 26% for systems installed between 2020 and 2022 and 22% for systems installed in 2023.

How does the federal solar tax credit work IRS?

Currently, this tax deduction allows you to claim 26% of the total cost of your solar system installation on your federal taxes. But this perk may not have come to stay. Unless Congress expands the ITC, it will drop to 22% for systems installed in 2023 and will end in 2024.

How does the 2021 solar tax credit work?

When you install a photovoltaic system in 2021 or 2022, 26% of your total project costs (including equipment, permits, and installation) may be claimed as a credit on your federal tax return. If you spend $ 10,000 on your system, you owe $ 2,600 less in taxes the following year.

How do you get the 26% tax credit for solar?

How do I claim the federal solar cell tax deduction? After applying for professional tax advice and ensuring you are eligible for the credit, you can complete and attach IRS Form 5695 to your federal tax return (Form 1040 or Form 1040NR).

How much of a tax credit do you get for going solar in California?

If you are a homeowner installing solar panels in California, you will receive a 26% tax deduction on the purchase.

Does California have a 2020 solar tax deduction? The Investment Tax Credit (ITC) provides an amount of 26% of the purchase price of your solar system to homeowners before 2020. Having a solar energy system installed in 2020 provides the maximum 26% California solar tax deduction before being scaled down to 22% in 2021.

What is the California tax credit for solar in 2021?

Homeowners installing solar panels in California will receive a 26% tax deduction on their purchases. It’s important to make a clarification here: There is no California-specific solar cell tax deduction.

Will solar tax credits increase 2021?

26% solar tax deduction is still available through 2022 Back in December 2020, Congress extended the federal tax deduction of 26% for solar energy until the end of 2022. With the original phasing-out plan, the solar tax deduction was reduced to 22% in 2021 and then to 10% for businesses in early 2022 (0% for homeowners).

What will the solar rebate be in 2021?

Government Solar Discount NSW (Feed-in Tariff) The Independent Pricing and Regulatory Tribunal (IPART) has quoted that the fair value of exported excess solar energy in 2020/21 varies from 6.0 to 7.3 cents per tonne. kilowatt hour.

How much of a tax credit do you get for going solar in California?

ITC is a 26% federal tax deduction for photovoltaic systems on both residential and commercial properties, reducing the tax liability of individuals or companies purchasing qualified solar technologies.

How much is the tax credit for solar in California?

Solar cell incentives, tax deductions and discounts in California * The 26% federal tax deduction is available for purchased solar cell systems for the home installed by December 31, 2022. Property tax deduction on home value added from the solar cell system on the roof.

How much of a tax credit do you get for going solar in California?

Although California does not offer a nationwide solar tax deduction, all residents are eligible for the current federal solar cell tax deduction. Solar tax deductions are worth 26% of the value of the installed system and may be required on federal tax returns.

How much do you get back in taxes for solar panels?

In December 2020, Congress passed an extension of the ITC, which provides a tax deduction of 26% for systems installed in 2020-2022 and 22% for systems installed in 2023. (Systems installed before December 31, 2019 were eligible for a 30% tax deduction.)

Does California give solar tax credits?

Although California does not offer a nationwide solar tax deduction, all residents are eligible for the current federal solar cell tax deduction. Solar tax deductions are worth 26% of the value of the installed system and may be required on federal tax returns.

How does solar tax credit work in California?

If a photovoltaic system is commissioned in 2022, you will be entitled to a tax deduction of 26% instead of 22%. You must purchase the system to claim ITC. Consumers can not claim the tax deduction for leases or Power Purchase Agreements (PPA).

Does California have tax credit for solar?

Most California residents are eligible to receive Federal Solar Investment Tax Credit – also known as ITC. The ITC was adopted in 2005 by the Energy Policy Act and initially covered up to 30% of the cost of installing a solar panel system.

Does California have a solar tax credit 2021?

One of the largest incentives available to homeowners in California is the Federal Investment Tax Credit (ITC). From now until 2021, the federal government will offer a 26% investment tax deduction against the total cost of a home solar system. In 2021, the value of the tax deduction will fall to 22%.