Federal Solar Energy Tax Credit – December 2021 Update If you install a solar system in 2021 or 2022, you can claim 26% of the total cost of your project (including equipment, permits, and installation) as a federal tax return credit. If you spend $ 10,000 on your system, you’ll owe $ 2,600 less in taxes next year.

Can you still get government grants for solar panels?

The government does not provide subsidies to solar panels in the traditional sense of the word, which pay in full or in part for the installation of your solar panels.

How big is the federal solar tax credit for 2021? Federal Investment Tax Credit (ITC) At the federal level, you qualify for the Federal Solar Investment Tax Credit (ITC). In 2021, ITC will provide a 26% tax credit on your solar panel installation costs, provided your taxable income is greater than the credit itself.

Is there a government stimulus for solar panels?

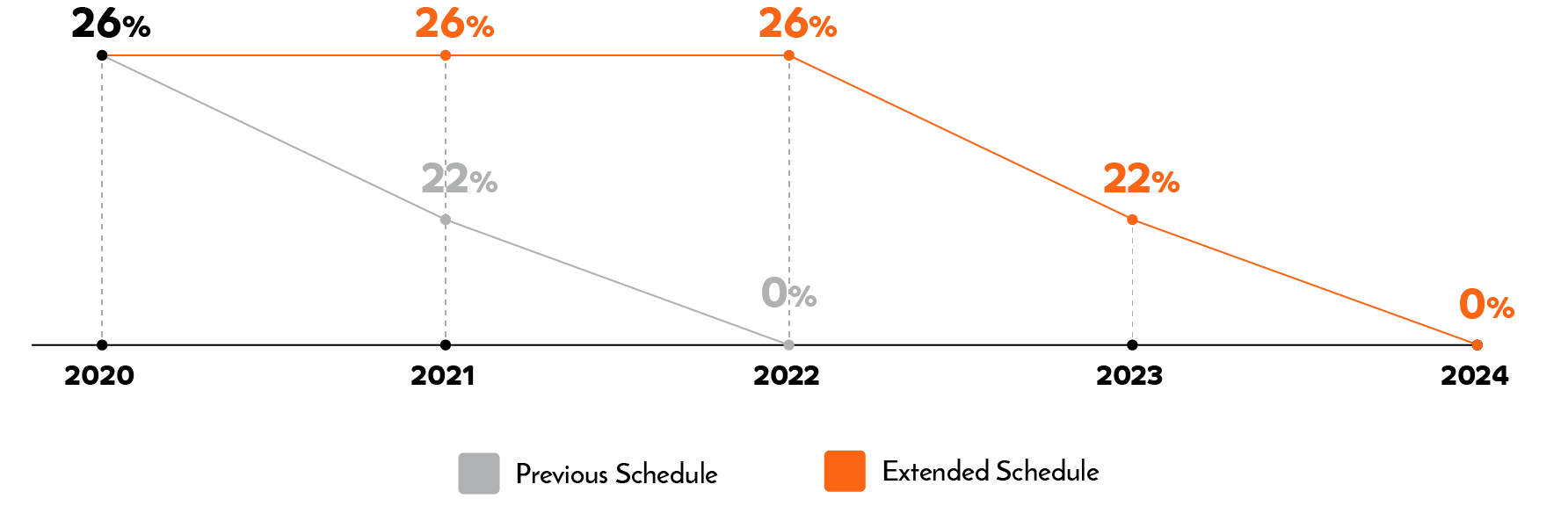

In December 2020, Congress approved an extension to the ITC that provides a 26% tax credit for systems installed between 2020 and 2022 and a 22% tax credit for systems installed in 2023 (systems installed before December 31, 2019 received a 30% tax credit). tax credit.) The tax credit will expire in 2024 unless Congress renews it.

Does the US government subsidize solar panels?

The Solar Energy Tax Credit, also known as the Solar Investment Tax Credit (ITC), is a federal initiative to support the growth of the solar industry in the United States. The ITC is a government grant in the form of a tax credit. Since the introduction of ITC in 2006, the solar industry in the United States has grown by 10,000%.

What is solar stimulus program?

Single-Family Affordable Solar Housing (SASH) Program Eligible low-income households can receive a one-time power-based incentive of $ 3,000 per kW of home installed solar energy.

Is there a federal tax credit for solar panels?

Installing solar panels earns you a federal tax credit. This means that you will receive your tax credit, which will actually reduce your tax bill. You are entitled to receive an ITC in the tax year in which you installed your solar panels as long as the system generates electricity for your home in the United States.

Are there any solar panel grants UK?

There are no subsidies for solar panels in the UK. In the past, the government provided interest-free loans and grants as part of a green deal, but this ended in 2015. The input tariff also ended in April 2019, but a new Smart Export Guarantee (SEG) began in January. 2020.

How much money do you get back from solar panels UK?

For example, a medium-sized home with a 4 kW solar panel system will spend around £ 6,000 to £ 8,000 on the system. You can expect to save around £ 270 a year on electricity bills and with a Smart Export Guarantee (SEG) you will reach break-even in 16-22 years.

Can you get free solar panels UK?

Can I get free solar panels in the UK? In the past, companies offered free solar panels, but the service is no longer available in the UK. As solar panels become more affordable, the government has sharply reduced its input tariff (FIT).

Does the government subsidize solar?

The MISI report found that non-hydropower renewable energy (mainly wind and solar) benefited from $ 158 billion in federal support, or 16% of the total, mainly in the form of tax policy and federal direct R&D spending.

Does solar ever pay for itself?

Keys included. Solar panels pay off over time, saving you money on your electricity bills and, in some cases, earning you money through current incentive payments. The average payback period for solar panels in the United States is 5-15 years, depending on where you live.

How much does the government spend on solar subsidies?

The federal government spent a total of $ 45.8 billion in tax incentives on solar and wind energy between 2005 and 2015. Of this, production tax credits accounted for 46.4% or $ 21.3 billion. Expenditure on 1603 financial contributions amounted to $ 20.4 billion, or 44.5% of the total.

Is solar power government subsidized?

The Solar Energy Tax Credit, also known as the Solar Investment Tax Credit (ITC), is a federal initiative to support the growth of the solar industry in the United States. The ITC is a government grant in the form of a tax credit. Since the introduction of ITC in 2006, the solar industry in the United States has grown by 10,000%.

What is the federal tax credit for solar in 2020?

In December 2020, Congress approved an extension to the ITC that provides a 26% tax credit for systems installed between 2020 and 2022 and a 22% tax credit for systems installed in 2023 (systems installed before December 31, 2019 received a 30% tax credit). tax credit.)

Is there a federal tax credit for solar panels? Installing solar panels earns you a federal tax credit. This means that you will receive your tax credit, which will actually reduce your tax bill. You are entitled to receive an ITC in the tax year in which you installed your solar panels as long as the system generates electricity for your home in the United States.

How much can I get back on taxes for solar panels?

The Solar Investment Tax Credit (ITC), or federal solar tax credit, has been one of the most successful incentives to boost solar energy growth in the United States. To compensate for the initial cost of solar energy, it makes it possible to deduct 26% of the use of solar energy. the total cost of your solar project from the federal taxes you owe.

How does solar tax credit work if I get a refund?

If you paid $ 5,000 and your tax refund is $ 3,000, you now only pay $ 2,000 in taxes. The solar tax credit will cancel this $ 2,000 and add it to your refund check. The remaining $ 1,000 solar tax credit will be deducted from next year’s taxes or whatever year you owe again.

Do you get a tax write off for solar panels?

You are entitled to receive an ITC in the tax year in which you installed your solar panels as long as the system generates electricity for your home in the United States. In 2021, the ITC will provide 26% tax credit for systems installed between 2020 and 2022 and 22% for systems installed in 2023.

How does the federal tax credit for solar work?

Federal Solar Tax Credit – December 2021 Update If you install a solar system in 2021 or 2022, you can claim 26% of your total project costs (including equipment, permits, and installation) as a credit to your federal tax return. If you spend $ 10,000 on your system, you’ll owe $ 2,600 less in taxes next year.

How does solar tax credit work if I get a refund?

If you paid $ 5,000 and your tax refund is $ 3,000, you now only pay $ 2,000 in taxes. The solar tax credit will cancel this $ 2,000 and add it to your refund check. The remaining $ 1,000 solar tax credit will be deducted from next year’s taxes or whatever year you owe again.

Do you get a tax credit every year for solar panels?

You are entitled to receive an ITC in the tax year in which you installed your solar panels as long as the system generates electricity for your home in the United States. In 2021, the ITC will provide 26% tax credit for systems installed between 2020 and 2022 and 22% for systems installed in 2023.

How much is California solar rebate?

If you fall into only one of these categories, you are entitled to an SGIP rebate of either $ 850 or $ 1000 per kWh. This amount is more than four times the value of the standard SGIP rebate. For most home energy storage options, this benefit covers the cost of installing the entire solar energy system.

What is the California tax credit for solar energy in 2021? Homeowners installing solar panels in California receive a 26% tax credit on their purchase. It is important to clarify here: There is no specific solar tax credit in California.

Is it worth going solar in California?

In most cases, solar energy in California is worth it. This incredibly sunny state provides more than enough sun to make the cost of solar energy worth it, and it doesn’t even take into account the numerous discounts and buy-back rates. In addition, the payback period is less than six years, which is one of the lowest in the country.

Do you actually save money going solar?

Solar panels and solar panel systems save you money and get a quick return on your investment. Rising property values, lower utility bills and a federal tax credit will alleviate the cost of installing solar panels.

Does solar increase home value in California?

The study found that each watt of sun added an average of $ 4 per watt to the value of a home in California and an average of $ 3 per watt elsewhere. This meant an average increase in home sales of $ 20,000 in California (4 x 5,000 W for an average system size) and $ 15,000 outside of California ($ 3 x 5,000 W).

Is there a downside to having solar?

Disadvantages of solar energy include high initial costs, inability to work on all types of roofs, and depending on where you live, it can be difficult to find a local installer.

What is the California solar tax credit for 2022?

If the solar system is commissioned in 2022, you will receive a 26% tax credit instead of 22%. You must purchase a system to apply for ITC. Consumers cannot claim a tax credit for a leasing or power purchase agreement (PPA).

Will there be a solar tax credit in 2022?

In December 2020, Congress approved an extension to the ITC that provides a 26% tax credit for systems installed between 2020 and 2022 and a 22% tax credit for systems installed in 2023 (systems installed before December 31, 2019 received a 30% tax credit). tax credit.) The tax credit will expire in 2024 unless Congress renews it.

Does California have a solar tax credit 2022?

Federal Solar Investment Tax Credit (ITC) ** Purchase and install a new home solar system in California in 2022, with or without a home battery, and receive a 26% federal tax credit. The residential ITC will fall to 22% in 2023 and end in 2024.

How much of a tax credit do you get for going solar in California?

If you are a homeowner installing solar panels in California, you will receive a 26% tax credit on your purchase.