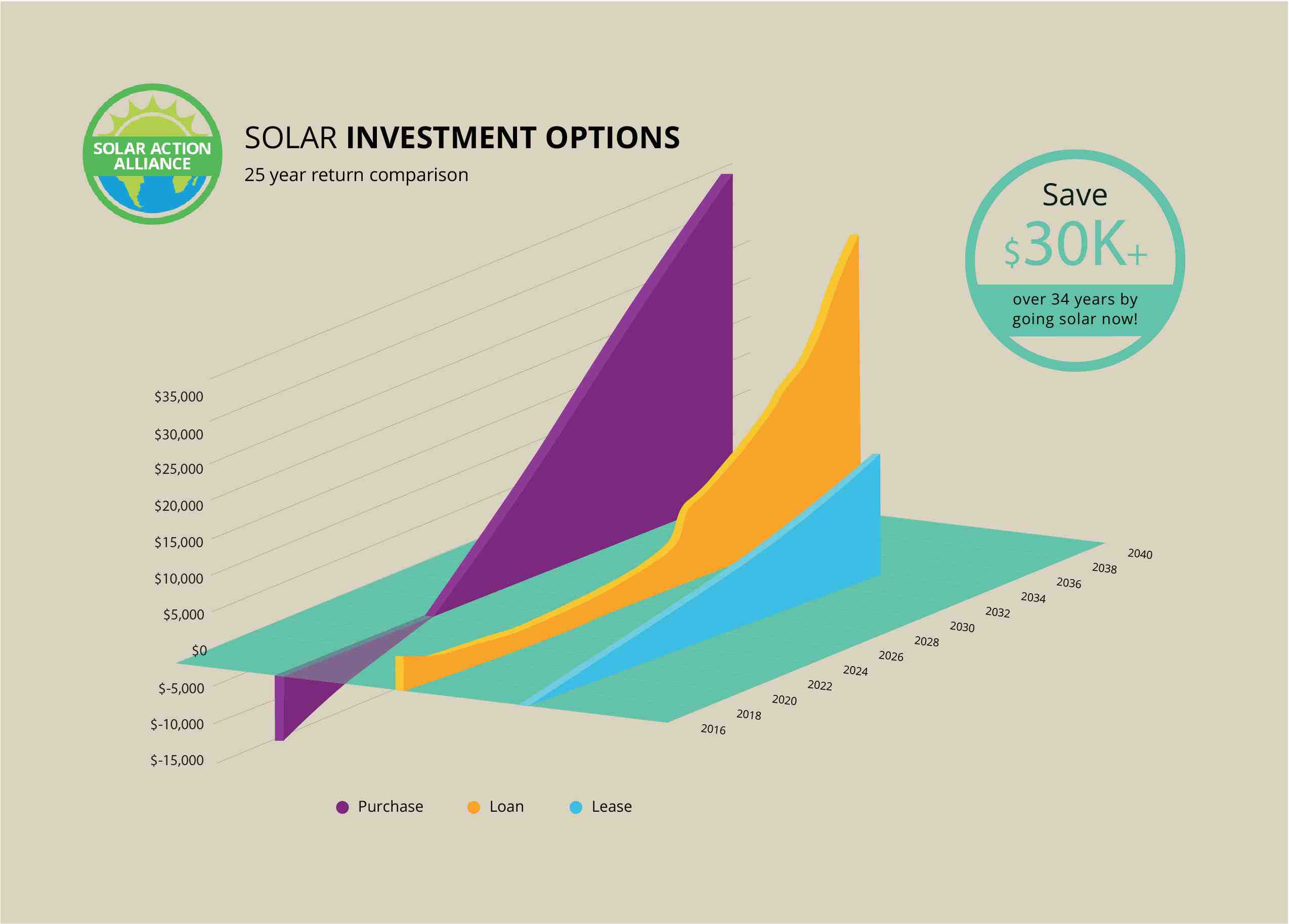

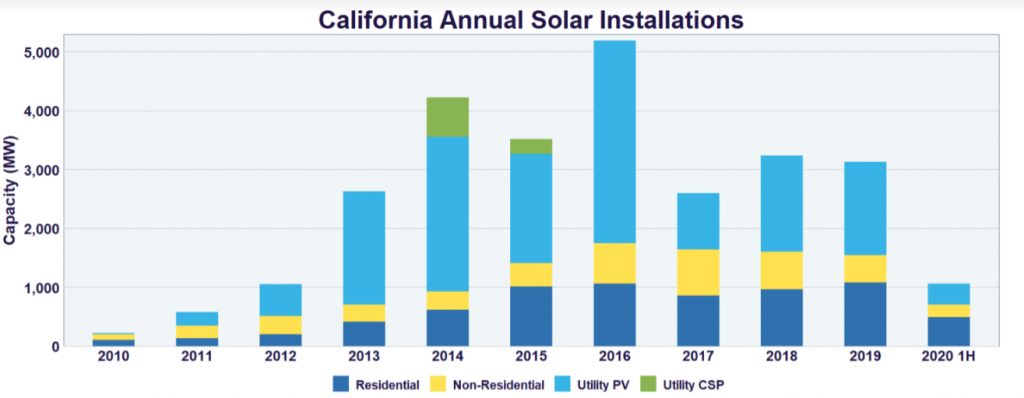

In many cases, the sun is useful in California. In this case, the sun provides more sunlight to value the cost of the sun, and does not affect the amount of repayment and resale. Also, the payback period is less than six years, one of the lowest in the entire country.

What is the California no cost solar program?

By combining rebates, forward, capacity -based and non -profit management, the SASH program enables its owners to homes are eligible to receive the sun at no upfront cost and at no ongoing cost, which means they reap all the financial benefits of the system.

Is there a solar tax credit in California 2020? The Investment Tax (ITC) pays a total of 26% of the purchase price of your solar generator to homeowners prior to by 2020. The installation of a solar power plant by 2020 will provide a total of 26% of California’s tax savings before the ‘ in steps down to 22% internally. 2021.

How much is the solar rebate in California?

Homeowners can find reimbursement programs in many parts of the Golden State. These refunds can pay customers anywhere from $ 300 in total to $ 0.95 per watt of installed capacity.

How much do you get back in taxes for solar panels?

In December 2020, Congress passed an amendment to the ITC, which provides for a 26% tax rate for installation systems in 2020-2022, and 22% for installation systems in 2023. (Installation systems before of December 31, 2019 was eligible for a 30% tax credit.)

Does California offer a tax credit for solar?

Federal Solar Investment Tax Credit Most Californians are eligible to receive the Federal Solar Investment Tax Credit — which is called the ITC. Regulated in 2005 by the Energy Policy Act, ITC was initially charged at 30% of the cost of solar installation.

Does California offer any incentives for solar?

California’s Single-Family Affordable Solar Housing (SASH) program provides incentives to eligible low-income single households to help meet the initial cost of four ‘ sunscreen.

Does California have a solar incentive?

California’s Single-Family Affordable Solar Housing (SASH) program provides incentives to eligible low-income single households to help meet the initial cost of four ‘ sunscreen.

Can you get free solar in California?

Opportunity and capacity. By combining rebates, forward, capacity -based and non -profit management, the SASH program enables its owners to homes are eligible to receive the sun at no upfront cost and at no ongoing cost, which means they reap all the financial benefits of the system.

Does California have a solar tax credit 2021?

One of the biggest incentives available to California homeowners is the Federal Investment Tax Credit (ITC). From now until 2021, the federal government is offering a 26% savings tax rate based on the total value of their home. By 2021, the cost of tax credit will be reduced by 22%.

What is the California solar tax credit for 2022?

If the sun is put in service in 2022, you qualify for 26% tax credit instead of 22%. You must purchase the ITC claim system. Consumers cannot claim tax credit for leases or Power Purchase Agreements (PPAs).

How much of a tax credit do you get for going solar in California?

If you are a resident of California, you receive a 26% sales tax.

Will there be a solar tax credit in 2022?

In December 2020, Congress passed an amendment to the ITC, which provides for a 26% tax rate for installation systems in 2020-2022, and 22% for installation systems in 2023. (Installation systems before of December 31, 2019 qualifies for a 30% tax credit.) The tax credit expires beginning in 2024 unless renewed by Congress.

Does CA offer tax credit for solar?

Federal Solar Investment Tax Credit Most Californians are eligible to receive the Federal Solar Investment Tax Credit — which is called the ITC. Regulated in 2005 by the Energy Policy Act, ITC was initially charged at 30% of the cost of solar installation.

How does IRS verify solar credit?

File claims for a tax credit To get the credit, you must file IRS Form 5695 as part of your tax return. You rate the debt in Part I of the form, then fill out the decision on your 1040.

How do I use my sun tax credit if I get a refund? If you paid $ 5,000 and your tax return is $ 3,000, you have only paid $ 2,000 in taxes. Your solar tax bill cancels that $ 2,000 and adds it to your refund check. The remaining $ 1,000 of their taxes will be deducted from the new year’s tax no matter what year you owe it.

Why am I not getting my full solar tax credit?

Your device must be installed in your first or second location. You must own the solar PV system, whether you have paid for it in advance or are financing the cost. (If you’re listing your use of the sun, you don’t maintain your eligibility to claim the tax credit.)

Will solar tax credit increase my refund?

Unfortunately, no. Instead, the ITC amount is based on your tax debt, or the money you owe the IRS at the time of income taxes. While the ITC escape directly reduces the amount you pay Uncle Sam dollar for dollar, it doesn’t put any cash back in your pocket as you might think.

How does the 2021 solar tax credit work?

If you install a sun in 2021 or 2022, 26% of the total cost of the work (including equipment, permits and installation) could be four. purchased as a credit to your federal tax return. If you spend $ 10,000 on your program, you owe $ 2,600 less in taxes the following year.

How do you get the 26% tax credit for solar?

How do I claim their federal tax credit? After you get professional tax advice and make sure you qualify for credit, you can complete and attach IRS Form 5695 to your file. federal tax return (Form 1040 or Form 1040NR).

Does IRS audit energy credits?

A review by the Treasury Tax Inspectorate found that the IRS was unable to accurately track and record debt for family strength. The IRS does not require third party records to prove that taxpayers actually purchased home improvements or made improvements to a major home.

How does federal tax credit for solar work?

Federal Solar Tax Credit – December 2021 Renewal When a solar eclipse is installed in 2021 or 2022, it accounts for 26% of the total operating costs (including equipment, permits and attach) can be purchased as a credit to your federal tax hearing. If you spend $ 10,000 on your program, you owe $ 2,600 less in taxes the following year.

Is solar worth it in California 2021?

Is the sun useful in California? As a general rule, solar energy is useful in California. Retail companies run retail and other reimbursement programs including low -income home economics.

Revenues from photovoltaic panels? The income from photovoltaic panels is below or equal to 70,000 â You must declare your profits to the Micro-Enterprise scheme also called Micro-BIC (Industrial and Commercial Profits). This is a tax regime for non-professionals. Your declaration will be on Form 2042 C Pro.

Quels sont les panneaux solaires les plus puissants ?

R-VOLT de Systovi, more than solar panel and fans: 900 W and aerovoltaic panel at 1.5 m²!

Quelle est la différence entre un panneau solaire et un panneau photovoltaïque ?

A solar panel turns solar energy into heat. On the use of salt water and the order of any building. A photovoltaic panel turns sunlight into electricity.

Quels sont les meilleurs panneaux solaires ?

The 3 best French solar panels

- The V-Sys of Systems. The panels of the French brand Systovi are available for the roofs by overlaying, integrating into the building, or on the floor. …

- The DualSun Flash Shingle. …

- The Biva 60 by Voltech Solar.

Quelle est la durée de vie d’une installation solaire ?

What is the average lifespan of a solar panel? The current consensus states that the lifespan of solar panels is between: 20 years, according to the most conservative estimates according to Engie; 30 or 40 years according to most developers (source: InSunWeTrust).

Comment toucher la prime à l’autoconsommation ?

The criteria for obtaining the self -consumption bonus

- Apply for photovoltaic installation that may require signage. …

- The panels must be installed on the roof of your home. …

- Before installing the saving solar at 100 kWc.

Qui verse la prime à l’autoconsommation ?

When you request a network connection, the amount of your auto -consumption premium is calculated. Its payment is made in 5 years, so you hit 1/5 of the sum every year. It is EDF OA that gives you, at the same time, the regulation of your annual bill, linked to the sale of your surplus.

Qui verse la prime à l’autoconsommation photovoltaïque ?

It is EDF Obligation d’Achat, a member of the French group, that receives the premium. The name of the company specifically speaks of: EDF is responsible for buying the electricity generated by the non -consumed solar energy and their housing.

Quelles sont les aides pour valoriser les installations en autoconsommation ?

The investment bonus for self -consumption You should therefore apply 1/5 of your premium, every year for 5 years. For example, a photovoltaic installation without a power of 100 kWc, yields a maximum of 10 000 € (comparison: 100 kWc X 100 € = 10 000 €).

Quelle prime pour le photovoltaïque ?

Photovoltaic self -consumption bonus The amount of self -consumption bonus depends on the installed power: 380€/kWc pour the power into one power consisting of 3 and 9 kWc. 160€/kWc to pour power including 9 and 36 kWc.

Qui verse la prime à l’autoconsommation photovoltaïque ?

It is EDF Obligation d’Achat, a member of the French group, that receives the premium. The name of the company specifically speaks of: EDF is responsible for buying the electricity generated by the non -consumed solar energy and their housing.

Quelle prime pour les panneaux photovoltaïque ?

380 €/kWc pour the lower or equal installations to 3 kWc; 280 €/kWc pour the plugs into 3 and 9 kWc; 160 €/kWc pour the plugs into 9 and 36 kWc; 80 ‚¬ discharge components at 36 and 100 kWc.

Quelle aide de l’État pour panneau photovoltaïque 2020 ?

Fa’amalama, it represents an aid ranging from 900 â to 1,800 â. In addition, you can get an ecological bonus of 500 â by installing solar panels! Symbols represent the 2,300 â pour photovoltaic installation.